Disclaimer

► The vast majority of numbers and amounts in this report are official data; the sources of such

data include the financial statements and annual reports of companies, information from the

official websites of the companies, and publications in media

► The financial statements of the companies have been obtained on the official websites of such

companies as well as from other sources

► If the source is not identified, such figures are calculations made based on judgment and

assumptions of the analyst. For such figures, the relevant calculation mechanisms and

assumptions are presented

► The red numbers in the report, for example (3), are solely a reference to sources of information.

The full list of sources is presented at the end of the report under the corresponding numbers

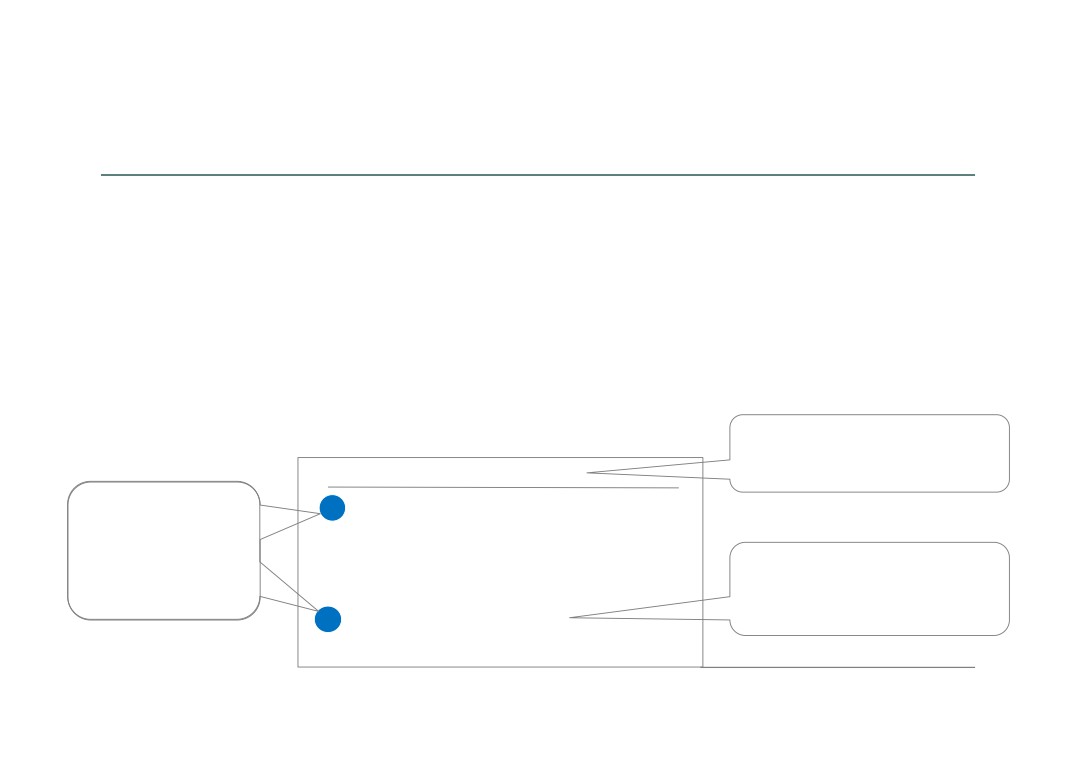

You should start reading the slide from

the key idea of the slide, which is

further explored in the slide

Key idea of the slide

A blue circle near the

► The vast majority of numbers and amounts in this report are official

1

data; the sources of such data include the financial statements and

text means that this

annual reports of companies, information from the official websites

report contains a

of the companies, and publications in media

separate slide with

► The financial statements of the companies have been obtained on the

additional information

official websites of the companies as well as from other sources

The sources are identified in the text,

on the relevant topic

► If the source is not identified, such figures are calculations made

but they are always marked with a

based on judgment and assumptions of the analyst. For such figures,

red number. The list of sources is

the relevant calculation mechanisms and assumptions are presented

presented at the end of the report

►2 The red numbers in the report, for example (3), are solely a reference

to sources of information. The full list of sources is presented at the

end of the report under the corresponding numbers

2

Mazepin Empire

Key observations (1/2)

►

Having nothing, Mr. Mazepin received billions of US dollars of Russian taxpayers in order to control Russian national

wealth. From 2004 through 2012, companies controlled by him acquired controlling interest in 4 major nitrogen

fertilizer producers with an approximate cost of acquisition of USD 1.1 billion (0). At the present moment, the assets

are under management of JSC «URALCHEM» (hereinafter, Uralchem). Most of the transactions have been financed by

Sberbank

►

In 2013, Mr. Mazepin acquired ~20% stake in potash giant PJSC Uralkali (hereinafter, Uralkali), the transaction was

financed by VTB Group, which issued a loan in the amount of USD 4.5 billion to Uralchem. After 5 years, the effective

ownership of Mr. Mazepin in Uralkali became ~89%. To achieve this goal, additional RUB 247 billion were spent, raising

from Sberbank and other foreign banks. The entire debt burden for the increase of the shareholding Mr. Mazepin

"hung" on Uralkali itself

►

These financial manipulations led to the total debt of Uralchem and Uralkali to banks in the amount of RUB 691 billion

at the end of 2018 or USD 11 billion in exchange for ~89% of the effective ownership in Uralkali, which holds 20%

market share of the global potash market and is a monopolist in the Russian market. The company's turnover in 2018

was equal to RUB 157 billion

►

Of RUB 691 billion of debt to banks at the end of 2018, RUB 590 billion were attracted for the purpose of seizing

control over Uralkali, however, these funds could have been spent on national projects in Russia, such as the

development of small and medium-sized business, and investments in enterprises. However, Mr. Mazepin did not

invest in the companies, spending money only to maintain business in operating condition, as it is apparent from the

lack of significant growth in production volume of Uralchem and Uralkali during the period of 2013-2018

►

Mr. Mazepin is not going to repay the borrowed funds to the banks, as according to the RAS financial statements of

the companies, debt repayment is mainly carried out by raising new loans from different banks. The total average

annual operating cash flow of Uralchem and Uralkali after deduction of interest and capital expenditures for

maintenance of fixed assets in 2016-2018 was approximately RUB 32.6 billion (RUB 34.3 billion relate to Uralkali and

minus RUB 1.7 billion relate to Uralchem), with the debt at the end of 2018 being RUB 691 billion. This is equivalent to

more than 20 years of debt repayment

►

In fact, this period can be significantly longer than 20 years, as in 2021-2022 EuroChem will launch its main potash

project with a planning capacity of 7.3 million tons per year at the first stage with increase to 14.6 million tons per year

by 2024. In comparison, production volume of Uralkali in 2018 was equal to 11.5 million tons. It is obvious that two

companies with such volumes will not fit and that the market will not be ready for such a significant increase in

consumption. Uralkali may expect a significant deterioration in its financial condition due to competition

3

Mazepin Empire

Key observations (2/2)

►

From a financial point of view, Uralchem matters have been much more serious for a long time. Over the last 5 years,

from 2014 to 2018, the company's net assets were negative and during the same period the company had a net loss in

4 out of 5 years. Moreover, the average annual operating cash flow for the period 2016-2018 after repayment of

interests and capital expenditures for maintenance of fixed assets was a negative value of minus RUB 1.7 billion. At

the same time, the debt to the banks was equal to RUB 282 billion. Thus, repayment of loans and borrowings is

impossible. Mr. Mazepin hopes only for Uralkali, but EuroChem will dash these hopes in the near future

►

The integrity of Mr. Mazepin in paying taxes raises reasonable doubts. A closer analysis may show a skillful

underpayment of a significant amount of taxes to the Russian budget by Uralchem and Uralkali for the period of 2014-

2018, which may have a range from RUB 83.7 to RUB 105.9 billion. The need to pay a substantial amount of interests

and foreign currency revaluation of loans and borrowings (Mr. Mazepin borrows loans for his companies mainly in

foreign currency) understates the income tax base annually. At the same time, the Government may collect the unpaid

amounts of taxes past the three-year statute of limitations only by opening criminal cases

►

Uralchem’s shareholders have not received dividends since 2015, and Uralkali has paid to shareholders only RUB 27

million since 2015 while the net profit was RUB 132 billion. The dividend tax rate in Russia is 15%, but it is 0% for non-

residents in Latvia. Income tax rate in Latvia is 5% less than in Russia…

►

In Latvia, Mr. Mazepin registered controlled [by him] traders, through which he sells products to export markets, while

Uralchem’s and Uralkali’s main focus is export. If the traders are controlled, nothing prevents Mr. Mazepin from

controlling sale prices from Russia to his own traders abroad. Mr. Mazepin controls traders not only in Latvia, but also

in other countries where he sells products extracted from the wealth of the Russian subsoil. The relationships and

prices among the controlled traders abroad are unknown, as the state authorities are not able to verify such

transactions from Russia

►

However, the relationships between Mr. Mazepin and Latvia are open to the entire world since he registered not only

traders, which generate significant profit and, as we believe, fail to pay taxes in Russia, but he also built the terminal

for transshipment of bulk fertilizers in the port of Riga in Latvia in 2013 and a year later, purchased the terminal for

transshipment of liquid ammonia at Ventspils port. Why not in Russia?

►

In Latvia, Mr. Mazepin also acquired Sconto soccer club and a hotel in Jurmala, while nothing has been invested in a

significant expansion of production of both companies in Russia since 2013, only for maintaining them in the

operating condition. And why? Uralchem and Uralkali have already been re-registered to Cyprus offshore companies

and no longer belong to Russia. Moreover, in accordance with some media reports, Mr. Mazepin already has a

residence permit in Latvia

4

Mazepin Empire

Having nothing, Mr. Mazepin received billions of US dollars of

Russian taxpayers in order to control Russian national wealth

Currently, Mr. Mazepin controls 2 multibillion-dollar turnover companies - Uralchem and Uralkali. The total turnover of these

1

companies in 2018 amounted to RUB 238 billion in accordance with RAS financial statements (1) or 0.29% of GDP of Russia (2)

►

Both companies produce mineral fertilizers from the national wealth of Russia. Uralchem uses natural gas for the production of

its main products - ammonia, urea and nitrate, and Uralkali - potash ore from 5 mines of the Ural region in Russia and holds

20% share of the world market (15) according to the company’s own data

►

Uralchem was founded in 2007, later consolidating 4 production assets:

2

► In 2004, Kirovo-Chepetsk chemical plant (currently, a branch “KCCP”) was purchased for USD 108.35 million at auction

(3). The story is silent on which money and how Mr. Mazepin, the former head of SIBUR, acquired control over the

above-mentioned production asset. One thing is known for sure that Mazepin never owned large assets and always was

an employed top-manager. At the same time, exactly during this auction Mr. Mazepin managed to overbid the offer of

Gazprom (!)

► In 2007, he obtained control over Berezniki “Azot” (currently, a branch “Azot”). The transaction value was not disclosed

but, according to analysts, the value of the asset could be from USD 264 to 377 million (4)

► In 2008, Uralchem received a loan in the amount of USD 700 million from Sberbank (5). Part of the loan was spent to

acquire control over JSC Voskresensk Mineral Fertilizers

► In 2012, Mr. Mazepin purchased Perm “Mineral Fertilizers" (currently, a branch "PMU") for approx. USD 300 million from

SIBUR (7)

In 2008, Mr. Mazepin turned his attention to another major producer of mineral fertilizers, Togliattiazot, firstly bought 7.5% of

shares from Viktor Vekselberg in 2008 (6). Subsequently, the shareholding was increased to 10% (6). Now, Mr. Mazepin is

actively fighting for this asset, accusing the former owners and top management of the company of the theft of previously

sold products. The conflict and the proceedings continue till the present time

(Х) - Reference to the source of information. The full list of sources of

5

information is presented at the end of the report

Mazepin Empire

Mr. Mazepin's purpose is to take over the Russian fertilizer

industry, simultaneously burdening the industry with significant

uncollectable loans

In 2013, VTB Group extended a USD 4.5 billion loan to Uralchem (8), a part of which in the amount of RUB 126 billion (8), was

3

directed to the acquisition of ~20% shares in Uralkali (9), secured by the same shares. However, before this transaction, Uralchem

had already had a debt of RUB 9 billion to Sberbank (10). As a result, this debt was restructured by Sberbank extending the

maturity date from October 2013 to October 2015

►

Immediately after the Uralchem acquisition of ~20% share in Uralkali, Uralkali received a credit approval from Sberbank for a new

credit line of up to USD 2 billion in December 2013 (11) for buying out shares of minority shareholders

The buy-out of shares from minority shareholders began by Uralkali in 2014, after Mr. Mazepin joined the company. For 5 years

3

from 2014 to 2018, the buy-out amount was RUB 247 billion (12), for which many loans were raised from both Russian and foreign

banks. Uralkali undertook the entire debt burden (interest, fees and foreign currency revaluation) of these loans

►

The total percentage of repurchased shares was ~55% as at 31 December 2018. These shares were transferred to Uralkali-

3

Technology, a wholly-owned subsidiary. The transferred shares became quasi-treasury, thus, proportionally increasing the

voting share of the other shareholders of Uralkali (47;77;78)

►

Also in 2016, Mr. Lobyak, a classmate of Mr. Mazepin from the Suvorov military school in Minsk, acquired control over ~20% of

3

Uralkali (13) by purchasing this stake through an offshore company, Rinsoco Trading, from ONEXIM group, which belonged to

Mr. Prokhorov. At the same time, Mr. Lobyak worked for Mr. Mazepin and led one of his structures in Belarus - «Yuras Oil». From

this perspective, there is no secret for anybody who actually is the real beneficiary of the ~20% stake owned by Mr. Lobyak and

under which financial guarantees these shares were purchased

►

As at 30 June 2019, Mr. Mazepin and Mr. Lobyak formally hold more than ~40% in Uralkali in the aggregate, but taking into

3

account the fact that the remaining ~55% are owned by Uralkali-Technology, a wholly-owned subsidiary, their effective ownership

(control) is ~89% (14) - in fact the full control

(Х) - Reference to the source of information. The full list of sources of

6

information is presented at the end of the report

Mazepin Empire

Mazepin has built a financial pyramid: from 2013 to 2018, Uralchem

and Uralkali received RUB 537 billion of loans, which were directed

solely for the seizure of control over Uralkali, but not on investments

in the Russian economy

According to RAS financial statements, at the end of 2018, the aggregate indebtedness of Uralchem and Uralkali for borrowed

4►

funds amounted to RUB 691 billion (16) or USD 11 billion at the rate of 63 rubles per 1 US dollar. Of which, RUB 409 billion (USD

6.5 billion) was the indebtedness of Uralkali and RUB 282 billion (USD 4.5 billion) was the indebtedness of Uralchem (16)

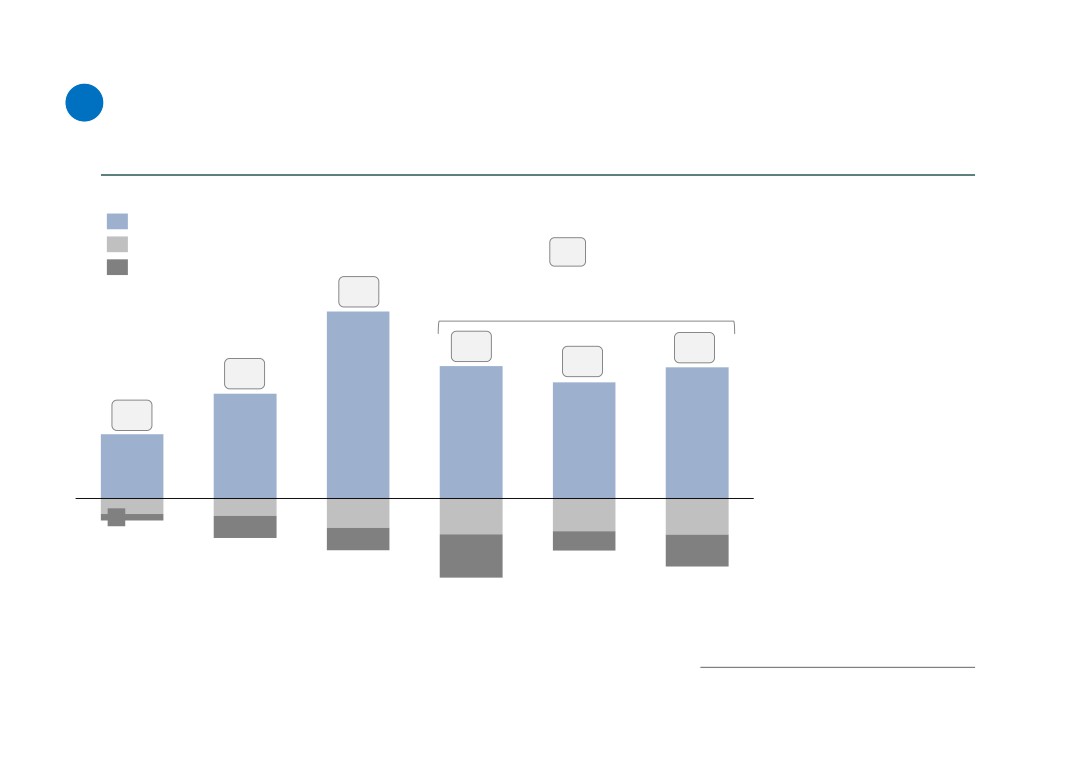

If we consider dynamics, the total debt of Uralchem and Uralkali was increased by more than 4.5 times or RUB 537 billion (from

4

RUB 154 billion to RUB 691 billion) since the beginning of 2013 through the end of 2018 (16). Both companies refinance their

5

debt to banks on a regular basis

►

The purpose of the total debt increase since the beginning of 2013 through the end of 2018 (RUB 537 billion) was not the

6

development of companies or investments into the Russian economy. It was only the seizure of control by Mr. Mazepin over

Uralkali, the largest company in the industry, in his own interest:

► Uralchem's investments in fixed assets for 6 years from 2013 to 2018 amounted to ~ RUB 16 billion (17), which is a

negligible amount compared to the growth of the debt balance by RUB 252 billion for the same period (18). At the same

7

time, there was no significant growth in production: in 2013, the volume of production amounted to 6 million tons (19), in

2018 - 6.4 million tons (20). Thus, investments were used solely to support current activities

► Uralkali’s investments in fixed assets for 6 years from 2013 to 2018 are considerably larger ~ RUB 83 billion (21), which at

7

first glance looks like a good result, but these investments are explained by the peculiarities of the business for the

extraction of potassium chloride including liquidation of the systematic accidents in the mines, e.g. sinkhole. The

increase of the debt balance for the comparable period amounted to RUB 285 billion (22)

► The volume of production was not increased, and on the contrary, only decreased by 5% or 0.6 million tons: 2014 - 12.1

7

million tons (23), 2018 - 11.5 million tons (23). Thus, all funds invested by Uralkali were also aimed only for maintaining

the company in operating condition

►

More than USD 6.5 billion (49) of the above-mentioned borrowings relate to loans received from state banks such as Sberbank

and VTB Group. Banks could issue these funds for national projects of the Russian Federation, for the development of small

and medium-sized business, so for the development of the Russian economy. But the banks were essentially deceived

►

Moreover, in case of non-repayment of loans, they will be written off to losses of the state banks net of the market value of

collateral. It will reduce the taxable profit of banks and thus, reduce the amount of income tax and tax on dividends payable to

the budget

(Х) - Reference to the source of information. The full list of sources of

7

information is presented at the end of the report

Mazepin Empire

Mr. Mazepin will not be able to repay loans to both state and

foreign banks, which will damage the economy and the image of

the Russian Federation, respectively

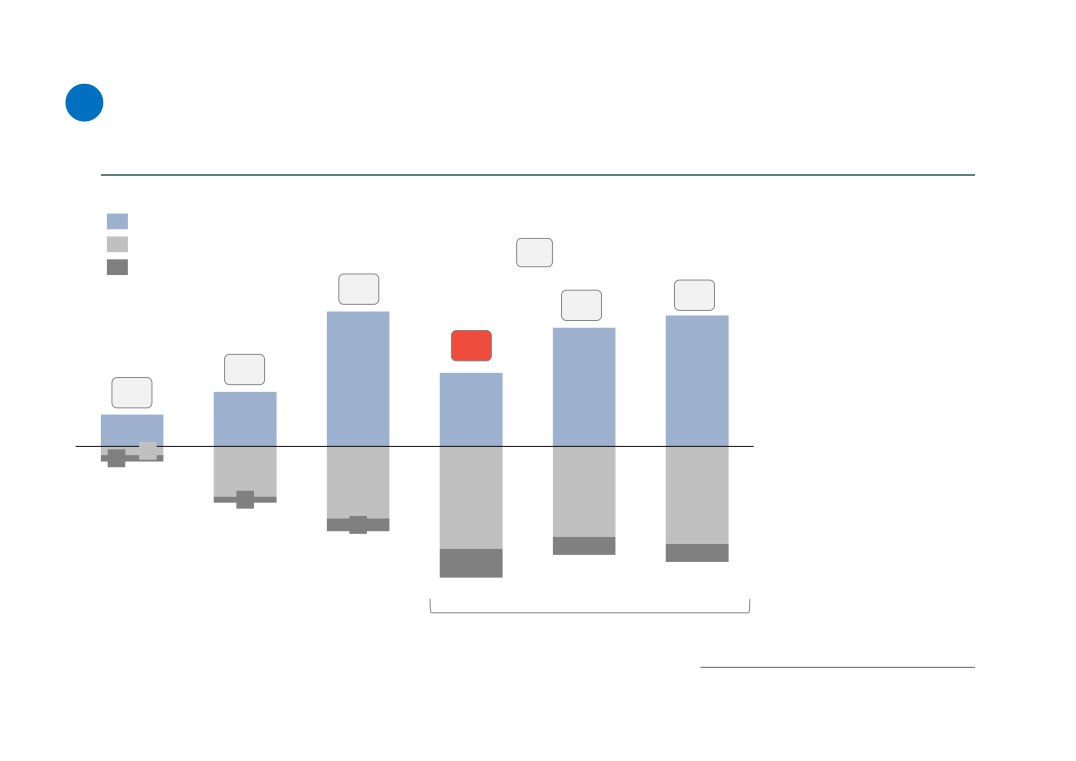

The average annual cash flow from Uralkali's operating activities for the period from 2016-2018 after deduction of interest and

8►

mandatory capital expenditures for maintaining the business in operating condition was RUB 34 billion (24). Therefore, Uralkali

10

may have a maximum amount of RUB 34 billion per year for the repayment of the total debt, which at the end of 2018 amounted

to RUB 409 billion (16). It is about 12 years of repayment

►

Uralkali is starting to compete with EuroChem Group in the Russian and global potash market, as the latter launches the

“EuroChem-Usolskiy” project - development of the Verkhnekamskoe potash deposit with reserves of about 2.3 billion tons of

ore (26). In 2018, 1.38 million tons of potash ore were produced (25), with the planned design production capacity of 2.3 million

tons per year (25)

►

In 2021 - 2022, EuroChem will launch the second project “EuroChem-VolgaKaliy” - development of Gremyachinskoe deposit in

Volgograd region with total reserves of about 1.6 billion tons of ore (27)

►

In 2018, Uralkali produced 11.5 million tons of potash ore (23), while EuroChem Group plans to reach the capacity of 7.3 million

tons in 2021 (27) and to increase capacity to 14.6 million tons annually by 2024 (26), which will certainly create significant

difficulties for Uralkali (even without taking into account the project “EuroChem-Usolskiy”)

►

If Uralkali has 20% of the world market (15), it is unlikely that the world market will withstand a much larger player in the face of

10

EuroChem Group. Any person, even without a special higher education, engaged in trading, understands the simple things - the

glut of the market with products will pull down prices and reduce volumes for 1 market player, which will have an extremely

negative impact on the financial condition of Uralkali and the ability to repay such a significant debt

►

With EuroChem entering the market, the repayment period of borrowed funds by Uralkali will definitely be much longer and will

be increased at least by 2 times, and the risk of non-repayment of loans and borrowings will increase significantly

►

At the same time, according to IFRS financial statements for 2018, Uralkali is going to significantly expand the credit limit with

Sberbank (28). Does Sberbank take into account the abovementioned circumstances? Sberbank can be deceived, which can

damage the economy of Russia in the form of non-repayment of loan funds

►

Moreover, capitalization of Uralkali since the end of 2013 has decreased by more than 2.5 times from RUB 506 billion to RUB

11

246 billion (29). The company's shares are pledged to banks and do not cover its total debt. In the case of a further decline of

market prices for potassium chloride due to the entry of EuroChem, which is more than likely, the decrease of capitalization will

continue

(Х) - Reference to the source of information. The full list of sources of

8

information is presented at the end of the report

Mazepin Empire

Now Uralchem is on the verge of bankruptcy, net assets were

negative from 2014 to 2018. Therefore, the company is subject to

liquidation in accordance with p.4 of art. 99 of the Russian Сivil

Сode

►

The situation is much worse for Uralchem as the company's net assets have been negative since 2014. At the end of 2014, they

12

amounted to minus RUB 77 billion (30) and at the end of 2018, they were record low of minus RUB 113 billion (31). Net assets

are assets of the company that are not burdened with liabilities. In other words, it is property earned by the company for the

benefit of shareholders, but Uralchem has negative assets

►

It is worth adding the following to the fact of negative net assets of Uralchem:

► there was net loss in the periods 2014-2015 and 2017-2018. The total financial result for the period of 5 years for 2014-

2018 was net loss in the amount of RUB 96 billion (33)

9

► the average annual cash flow from operating activities of Uralchem for the period of 2016-2018 after the payment of

interest and mandatory capital expenditures to maintain the business in operating condition was negative and was equal

10

to minus RUB 1.7 billion (32)

4

► accumulated debt on borrowed funds at the end of 2018 amounted to RUB 282 billion (16)

10

► thus, debt repayment by using own funds is impossible

On the basis of extremely negative performance indicators, there is no doubt that Uralchem constantly breaches covenants,

i.e. banks (primarily Sberbank) may at any time claim early repayment of loans

►

Since 2015 Uralchem Group has stopped publishing IFRS financial statements. The most likely reason is the refusal of the

opinion by the big4 auditor, Deloitte, due to the group’s inability to continue its operations as a going concern in the

foreseeable future, i.e. its probable liquidation

1►

According to p.4 of art.99 of the Civil Code of the Russian Federation, if joint-stock company has negative net assets within 2

and more years, it is subject to liquidation. Uralchem's net assets have been negative for 5 years since 2014. The Federal Tax

Service of Russia has the right to sue the company of any organizational-legal form on the grounds established by the laws of

the Russian Federation and the Central Bank of the Russian Federation has the right to issue orders to remedy violations of

legal requirements (Federal law "On joint stock companies"), but no action is taken! Why? Is Mr. Mazepin covered by certain

officials, or does he cleverly manage to deceive the state authorities?

►

Uralchem is subject to liquidation on the basis of p.4 of art.99 of the Civil Code of the Russian Federation

►

In case of liquidation of Uralchem, almost all of its market share, including the export market, will be divided between Russian

companies-competitors, which instead of Uralchem conduct efficient economic activities and are conscientious taxpayers. For

example, these companies are Kuibyshevazot, Togliattiazot, NAK Azot, Nevinnomyssk Azot. Thus, the Russian budget will

finally begin to receive revenue for income tax and dividends. Looking ahead, it is from RUB 9.2 billion to RUB 10.4 billion per

year (34)

1►

The main creditor of Uralchem is VTB Group, loan from which is essentially unsecured. Even if VTB forecloses on the ~20%

1

shares in Uralkali from Uralchem, VTB will have a loss due to the low value of the collateral that is unequal to the loan value,

because the market price of shares has declined since their purchase more than 2 times (29)

(Х) - Reference to the source of information. The full list of sources of

9

Mazepin Empire

information is presented at the end of the report

The integrity of Uralchem and Uralkali in calculating and paying taxes

is raising reasonable doubts. There is a reason to believe that the

underpayment of taxes by these companies for the period of 2014-

2018 was within the range of RUB 83.7 to RUB 105.9 billion

►

Uralchem and Uralkali raised credit funds in foreign currency for the repurchase/buy-out of shares in Uralkali. Foreign currency

liabilities have been subject to revaluation due to depreciation of ruble against dollar, which depreciated by more than 2 times for

the period of 2014-2018

►

Interest and foreign currency revaluation on foreign currency loans were recognized by Uralkali and Uralchem as expenses that

reduced taxable profit for the period of 2014-2018. Accordingly, income tax payments to the Russian budget were significantly

reduced

1►

The total amount of expenses incurred for the period of 2014-2018 was:

► Interest expense: RUB 64.1 billion by Uralchem (80), RUB 48.6 billion by Uralkali (80)

21

► Foreign currency revaluation: RUB 126.6 billion by Uralchem (35), RUB 64 billion by Uralkali (35)

►

Interest and currency exchange differences on loans can reduce taxable profit only if the loan is spent by the company on activities

aimed for earning income (art. 252 of the Tax Code of the Russian Federation)

►

Uralchem acquired ~20% stake in Uralkali for RUB 126 billion (8;9) in December 2013 by using a foreign currency loan from VTB

Group. The market value of Uralkali's share of ~20% was equal to RUB 100 billion in December 2013 (79). A significant excess of the

acquisition cost over the market value in the amount of RUB 26 billion should have been seriously analyzed

►

Prior to the acquisition by Mr. Mazepin, Uralkali consistently paid dividends in average in the amount of RUB 19.5 billion per year

(RUB 58 billion for the period of 2011-2013) (66). However, starting from 2015, the total amount of dividend payments has been only

RUB 27 million (66), i.e. Uralchem received almost no income from the investment in Uralkali. The reason for this was the

subsequent large-scale buy-out of shares of Uralkali by using credit funds in foreign currency (including USD 2 billion from

Sberbank (11)), for which the company recognized interests and currency exchange differences. Uralkali incurred expenses in the

total amount of RUB 102.6 billion for the period of 2014-2018 and also had no free funds for payment of dividends, directing the

existing funds to the current debt service and repayment of the received loans (already at the increased exchange rate of RUB/USD)

►

Thus, the received credit funds were not spent by both companies to generate income. We believe that they were spent for the

personal benefit of one person, Mr. Mazepin.

15►

After the takeover of Uralkali by Mr. Mazepin in December 2013, the total amount of underpaid taxes to the Russian budget for the

16

17

period of 2014-2018 can range from RUB 37.9 billion to RUB 54.1 billion by Uralkali (41) and from RUB 45.8 billion to RUB 51.8

billion by Uralchem (42)

19

20

►

The tax authorities should pay attention to the tax burden of Uralkali and Uralchem and assess the integrity of tax optimization on

21

these transactions

►

Undisguised friendship of Mr. Mazepin with certain high-ranked officials from law enforcement agencies (in particular from the

Investigation Committee of the Russian Federation) and the Federal Tax Service of the Russian Federation helped to hide the true

state of affairs with taxation. Could these relationships of Mr. Mazepin help him to escape liability now? It is also worth noting, that

the Government may collect the unpaid amounts of taxes past the three-year statute of limitations only by opening criminal cases

(Х) - Reference to the source of information. The full list of sources of

10

Mazepin Empire

information is presented at the end of the report

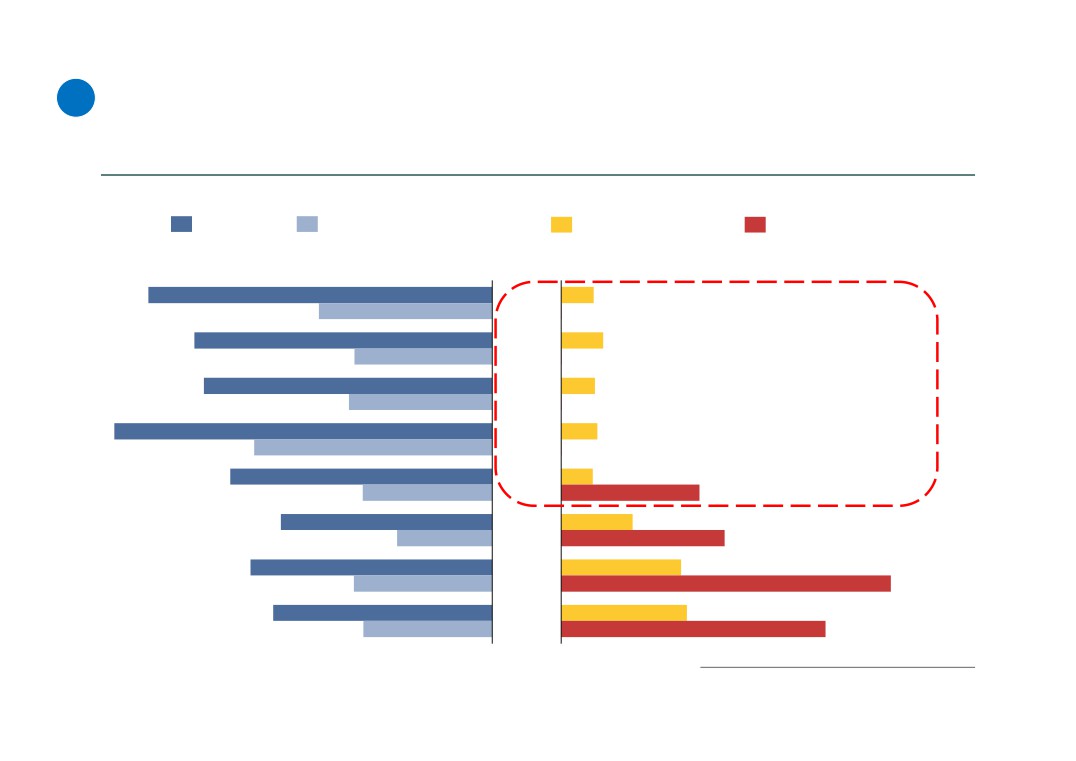

Financially comparable companies pay significantly more taxes to

the budget than Uralchem and Uralkali, which confirms the bad

faith of tax calculations and underpayment of taxes

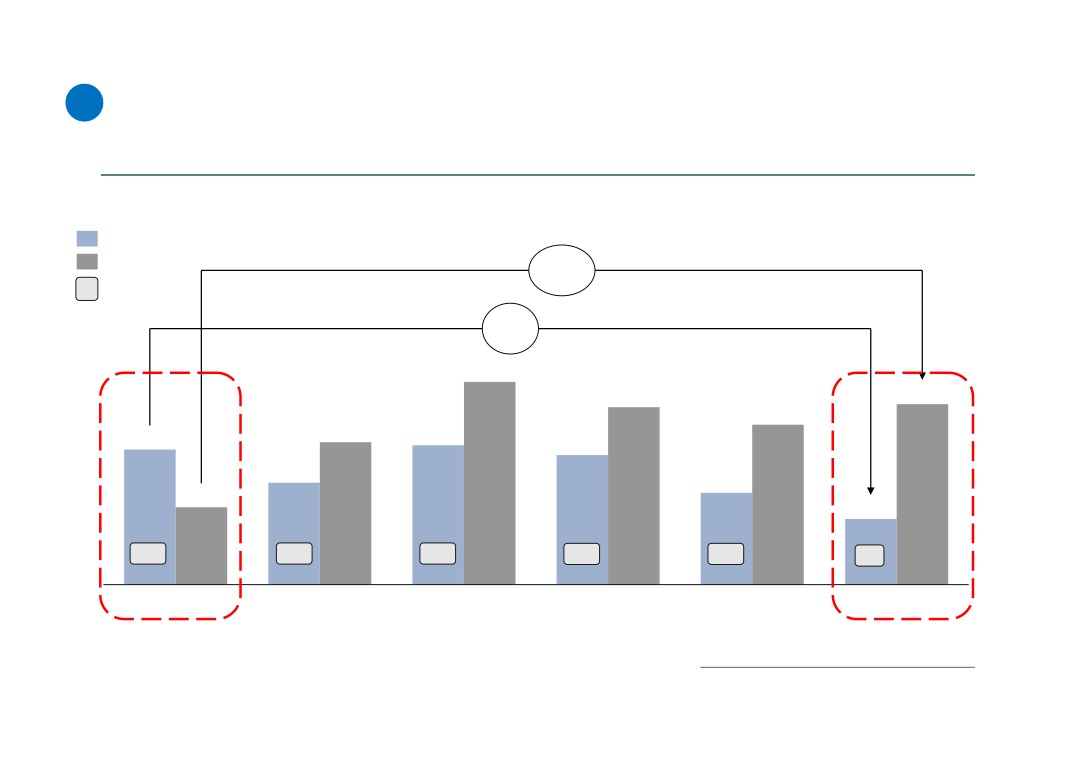

13 Uralkali has virtually terminated dividend payments and substantially reduced payments of income tax starting with 2014. After

Mazepin’s arrival over a period of 5 years in 2014-2018, the company paid only RUB 13.5 billion of income tax (36). For example,

for the period of 3 years in 2011-2013, it paid RUB 24.5 billion of income tax (37)

14

► For example, LUKOIL-Perm, also being the largest enterprise in the Perm region, paid 4 times more of income tax to the budget

for the period of 5 years in 2014-2018 than Uralkali - RUB 53.5 billion (38)

18

► Uralchem, in comparison with similar companies, has the highest rates of revenue and profit on sales, but also does not pay

taxes. Since the end of 2013, only RUB 2.7 billion (39) of income tax and dividend tax have been paid.

18

►

2 peer companies belonging to the Swiss EuroChem Group, Nevinnomyssk Azot and NAK Azot, having a lower profit margin on

sales jointly paid since the end of 2013 RUB 39.9 billion (40) - 15 times more than Uralchem

► It is worth considering what will happen with other companies in the industry of mineral and nitrogen fertilizers, to which Mr.

Mazepin will turn his interest, after the complete buy-out of shares from minority shareholders of Uralkali. Further actions will be

taken in a similar way: a bank loan for the purchase of shares - purchase of shares (obtaining control) - squeeze-out of minority

shareholders - obtaining new loans - reduction of tax payments to the Russian budget

► How long will Mr. Mazepin continue to do the same? How much the budget of Russia will not receive? Which company will be the

next victim? We believe that at this rate, according to the established scheme, Mr. Mazepin has the opportunity to seize control

over the entire industry of mineral and nitrogen fertilizers in Russia. We also believe that he will continue to buy property for his

own purposes at the expense of underpaid taxes

(Х) - Reference to the source of information. The full list of sources of

11

information is presented at the end of the report

Mazepin Empire

Uralchem has not paid dividends since 2015, Uralkali has paid only RUB

27 million to shareholders since 2015, while the net profit was RUB 132

billion. At the same time, all export transactions are carried out through a

chain of controlled traders

►

Uralkali sold 11.1 million tons of potash ore in 2018 (11.5 million tons were produced) (23). Against the background of such large

sales, the export share, according to the company, was equal to 76% in 2018 (43). Export sales are made through traders

controlled by Mr. Mazepin - Uralkali Trading SIA, Uralkali Trading SIA - Panama Branch, Uralkali Trading SIA - India Branch,

Uralkali Trading SIA - Singapore Branch, Latvia Uralkali Trading SIA Beijing Representative Office, Uralkali Trading SIA - Turkey

Branch (44)

►

Uralchem also has the export orientation but the exact sales amounts are hidden from the public. The company does not hide

that it sells all export products through controlled traders, in particular, SIA Uralchem Trading (44)

►

Main traders, Uralkali Trading SIA and SIA Uralchem Trading, are registered in Latvia, an unfriendly to Russia country. The

companies’ operating profits are tens of millions of US dollars. Thus, a significant part of taxes does not remain in the Russian

economy

►

We believe that the goal of deception in Mr. Mazepin’s sales model is that all export traders are under his control, that means he

controls the pricing of sales of products from Russia to foreign traders, which leaves them with a significant profit. Transactions

are made abroad, thus, no one can be sure that there are the real buyers behind the Latvian traders - it can be a chain of their

own traders, where the difference between the purchase price and sale price of products can be more than tens of millions of US

dollars, e.g. hundreds of millions. Some other companies are URALCHEM TRADING DO BRAZIL LTDA, Uralkali Trading

Fertilizantes Brasil LTDA, Uralkali Trading Chicago (44)

►

We cannot exclude the possibility that all controlled foreign traders resell products to each other intentionally to leave a

significant profit abroad. Information on these transactions cannot be verified from Russia. The funds to buy ~20% stake in

Uralkali could have been transferred to Rinsoco Trading of Mr. Lobyak in this exact way (for example, in the form of borrowing).

►

The evidence of the accumulation of significant funds abroad bypassing the Russian economy may be a loan of USD 650 million

given by the company Uralkali Finance DAC to Uralkali in 2013 (45). How the same-name company (Uralkali Finance DAC) could

generate such significant funds abroad, which were available for credit facility?

►

Why should Mr. Mazepin pay dividends in Russia or pay taxes at a relatively high rate to the Russian budget, when it is possible

to receive dividends from foreign controlled traders abroad? For example, in Latvia, there is no tax on dividends for non-

residents at all, and the income tax rate is also lower than in Russia, only 15%. Moreover, no one will be able to see and verify in

Russia the tax payments, implemented by Mr. Mazepin abroad

(Х) - Reference to the source of information. The full list of sources of

12

information is presented at the end of the report

Mazepin Empire

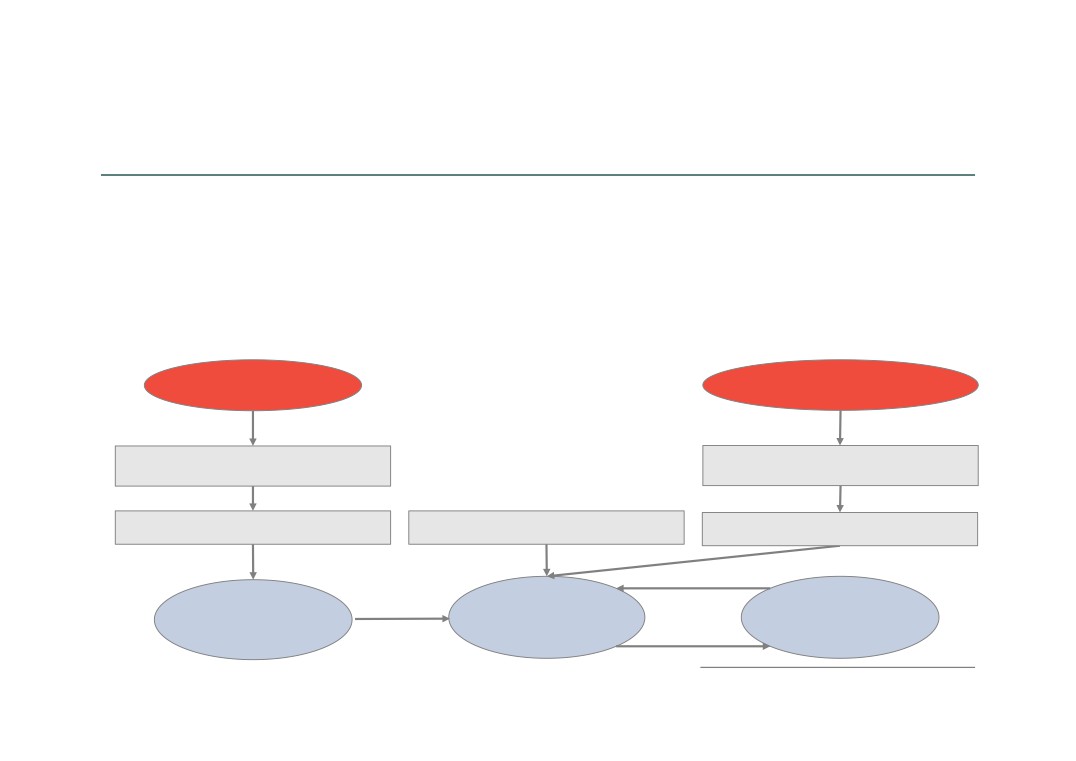

Uralchem and Uralkali do not belong to Russia anymore - Mazepin

re-registered companies to offshore zones

►

100% share of Uralchem belongs to Uralchem Holding P.L.C., registered in Cyprus, which in its turn belongs to QUILAN

MANAGEMENT LTD, registered in the Virgin islands, and ~86% owned by Mr. Mazepin (46)

► Uralchem, in its turn, owns ~20% share of Uralkali (47). Another ~20% share of Uralkali belongs to the Cyprus company, Rinsoco

Trading (47), ~55% shares are quasi-treasury and owned by Uralkali-Technology (47), which is a wholly-owned subsidiary of

Uralkali (47). Effective ownership (control) of Uralchem and Rinsoco Trading over Uralkali as at 30 June 2019 was ~89% (14)

► Foreign registration of assets means for Russia the withdrawal of tax proceeds, dividends, as well as, perhaps, the assets

themselves outside of the Russian economy. In case of disagreement of Mr. Mazeptin with Russian authorities and banks it can

be very difficult or almost impossible to seize the property of foreign companies in foreign courts

Mr. Lobyak

Mr. Mazepin

(Mazepin’s partner)

~86%(46)

100%(48)

QUILAN MANAGEMENT LTD

Bromwich investments LTD

Virgin Islands

Virgin Islands

~100%(46)

100%(48)

Uralchem Holding P.L.C. - Cyprus

Minority shareholders

Rinsoco Trading - Cyprus

~5%(47)

~100%(47)

~20%(47)

~20%(47)

~55%(47)

Uralkali

Uralchem

Uralkali

Technology

100%(47)

(Х) - Reference to the source of information. The full list of sources of

13

information is presented at the end of the report

Mazepin Empire

Summary of explanatory information

1.

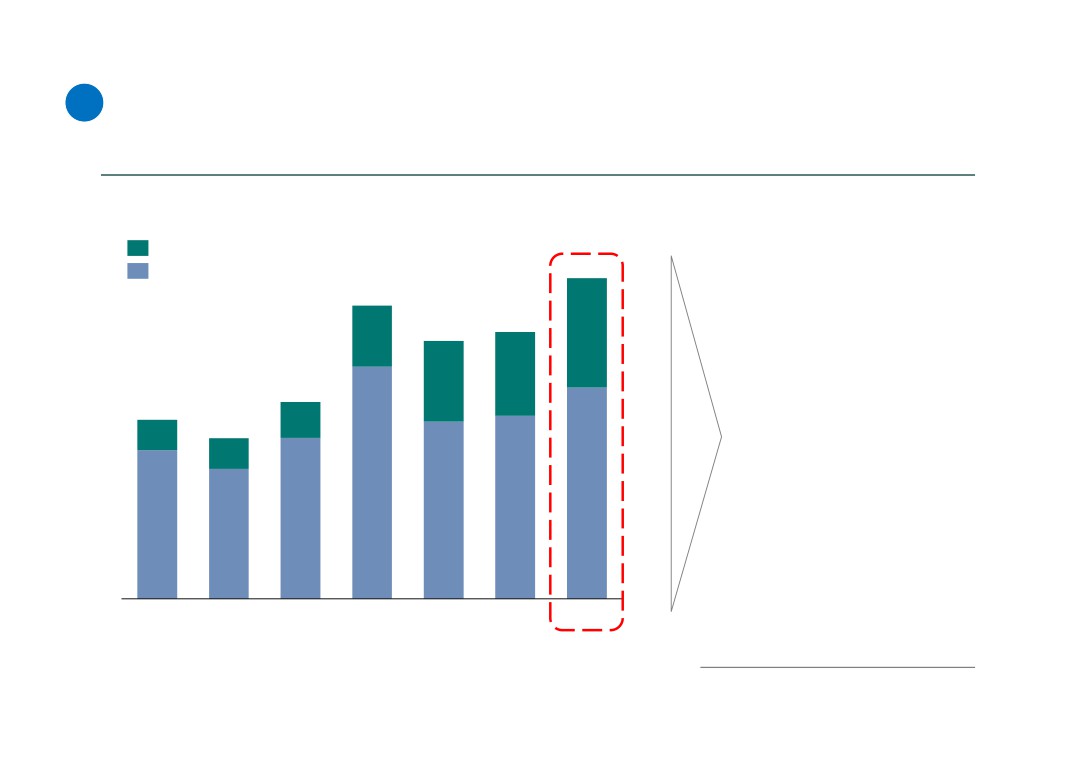

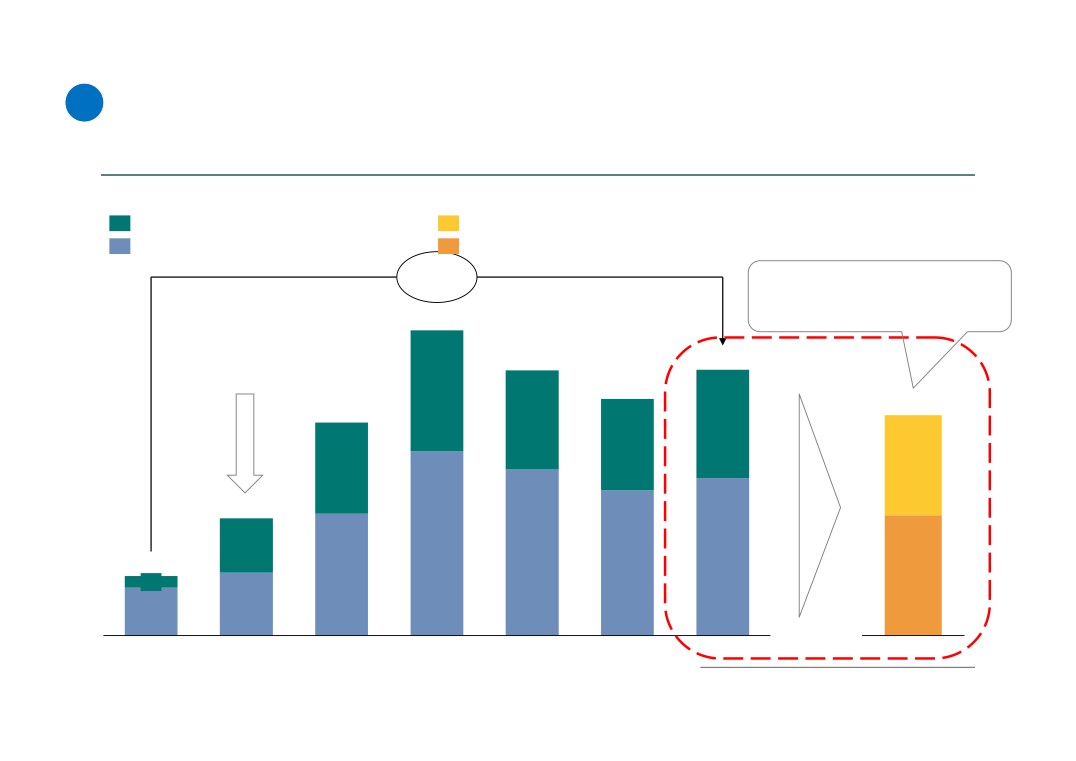

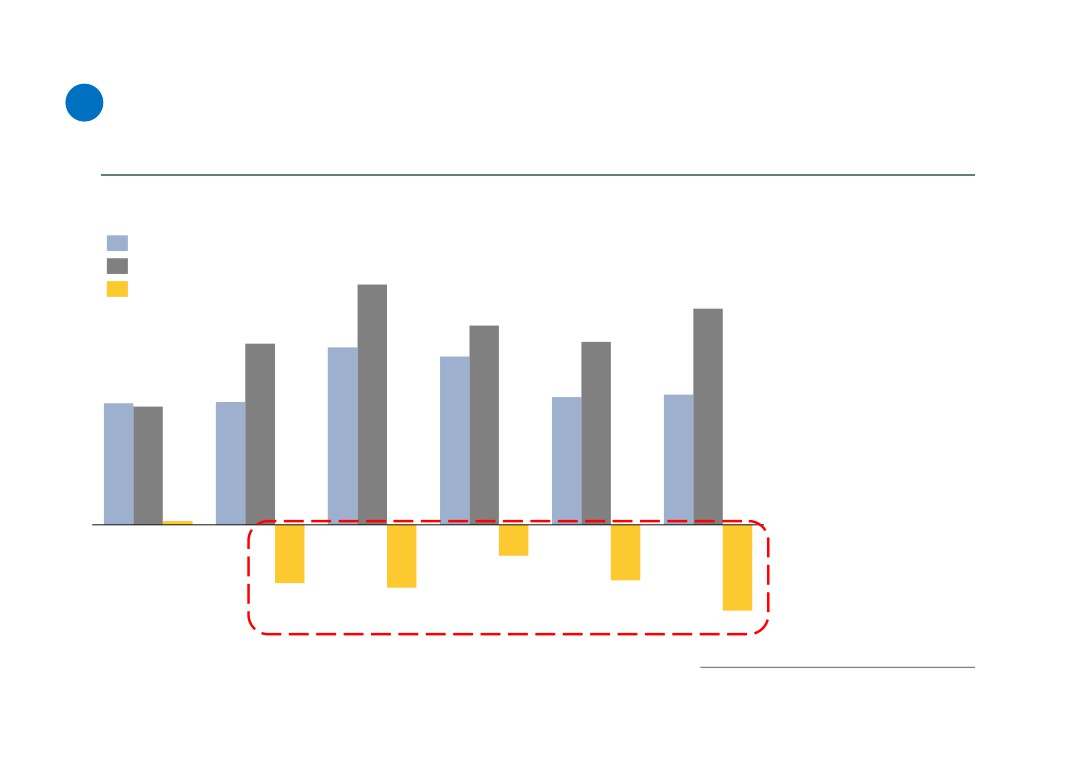

Dynamics of cumulative revenue of Uralchem and Uralkali for the period of 2012-2018

2.

Structure of production assets of Uralchem as at 2018

3.

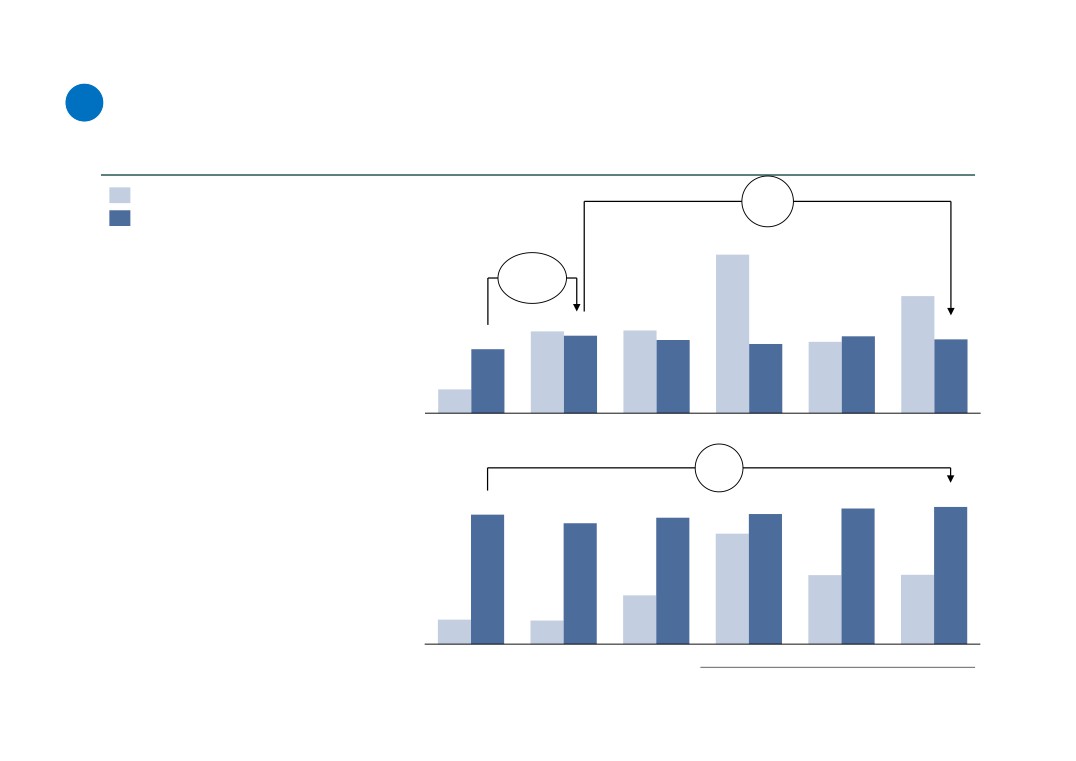

Dynamics of the change of equity structure of Urkalkali from 2013 to 2019

4.

Dynamics of the balance of borrowed funds of Uralchem and Uralkali for the period of 2012-2018

5.

Dynamics of proceeds and repayments of loans and borrowings by Uralchem for the period of 2013-2018

6.

Dynamics of proceeds and repayments of loans and borrowings by Uralkali for the period of 2013-2018

7.

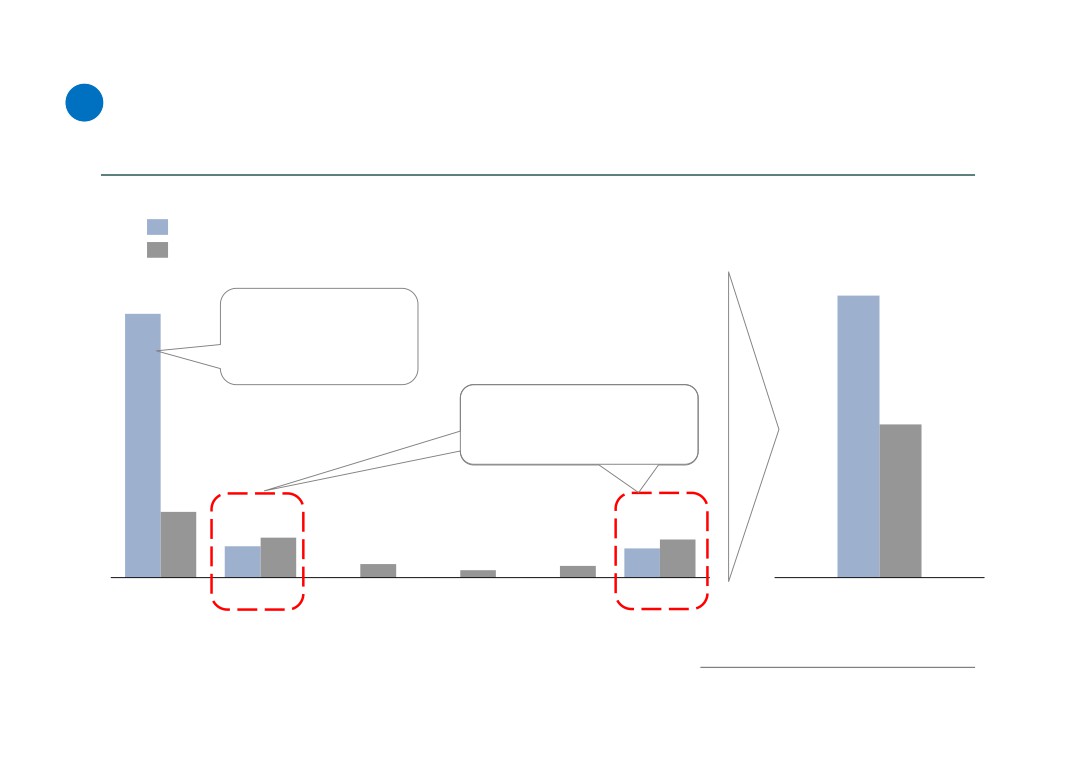

Dynamics of capital expenditures and production volumes for Uralkali and Uralchem for the period of 6 years in 2013-2018

8.

Average annual operating cash flows of Uralkali for the period of 2016-2018, after deduction of interest and mandatory capital

expenditures to maintain the business in operating condition

9.

Average annual operating cash flows of Uralchem for the period of 2016-2018

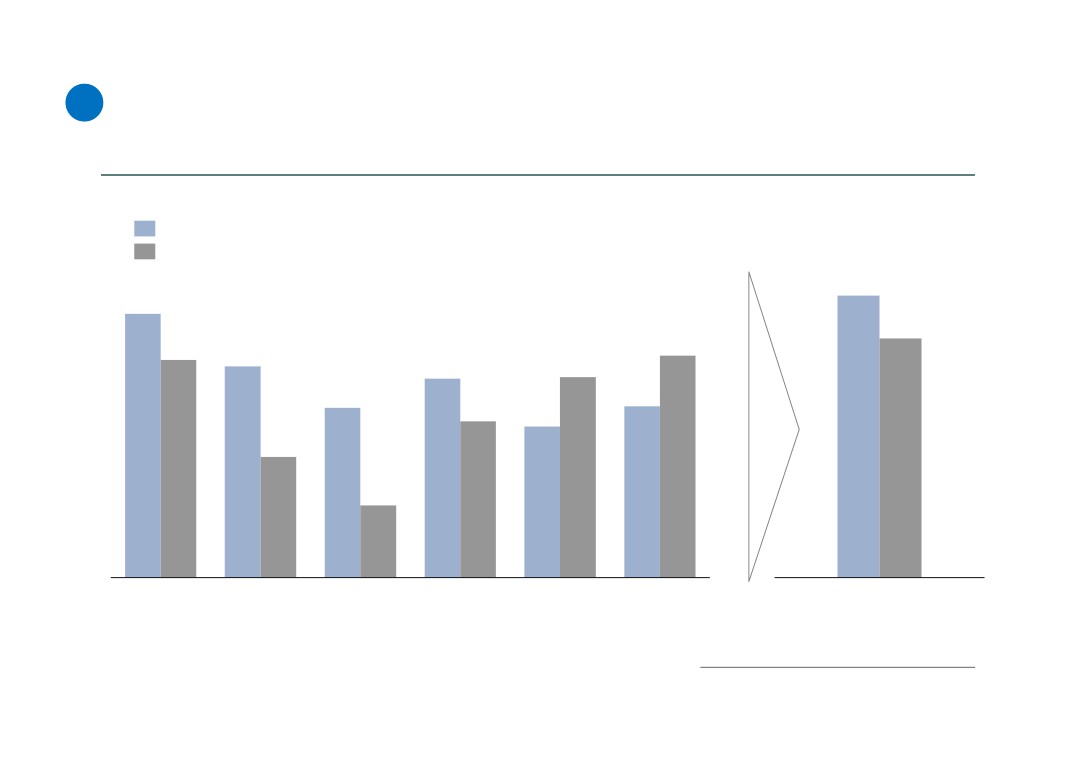

10.

Forecast repayment of loans and borrowings by Uralchem and Uralkali

11.

Dynamics of changes in net assets of Uralchem for the period of 2013-2018

12.

Dynamics of capitalization and total debt of Uralkali since the end of 2013

13.

Dynamics of key performance indicators for Uralkali for the period of 2011-2018

14.

The largest taxpayers of Perm region for the period of 5 years in 2014-2018

15.

Assumptions used in calculating the amount of underpaid taxes by Uralkali to the budget of the Russian Federation for the period of

2014-2018

16.

Assumptions used in calculating the amount of underpaid taxes by Uralkali to the budget of the Russian Federation for the period of

2014-2018 (continued)

17.

Calculation of the amount of underpaid taxes by Uralkali for the period of 5 years in 2014-2018

18.

Key performance indicators of major comparable companies similar to Uralchem over a period of 5 years, 2014-2018.

19.

Assumptions used in calculating the amount of underpaid taxes by Uralchem to the budget of the Russian Federation for the period

of 2014-2018

20.

Assumptions used in calculating the amount of underpaid taxes by Uralchem to the budget of the Russian Federation for the period

of 2014-2018 (continued)

21.

Calculation of the amount of underpaid taxes by Uralchem for the period of 5 years in 2014-2018

(Х) - Reference to the source of information. The full list of sources of

14

information is presented at the end of the report

Mazepin Empire

Currently, Mr. Mazepin controls 2 multi-billion turnover companies

Uralchem and Uralkali. The total turnover of these companies for 2018

1

amounted to RUB 238 billion in accordance with RAS Financial

statements or 0.27% of GDP of Russia

Dynamics of cumulative revenue of Uralchem and Uralkali

for the period of 2012-2018, RUB billion (1)

Uralchem

238

Uralkali

►

Increase of revenue

217

since 2013 is explained

by favorable market

198

environment and

191

81

45

condition for Uralchem

and UraIkali, as well as

devaluation of ruble

62

60

exchange rate, as both

146

companies are export-

133

oriented

27

119

23

►

There was no increase

23

in production volumes

and, as a result, sales

172

volumes

157

136

►

GDP of Russia is RUB

131

119

110

103.6 trillion in

96

accordance with

Kommersant (2)

2012

2013

2014

2015

2016

2017

2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

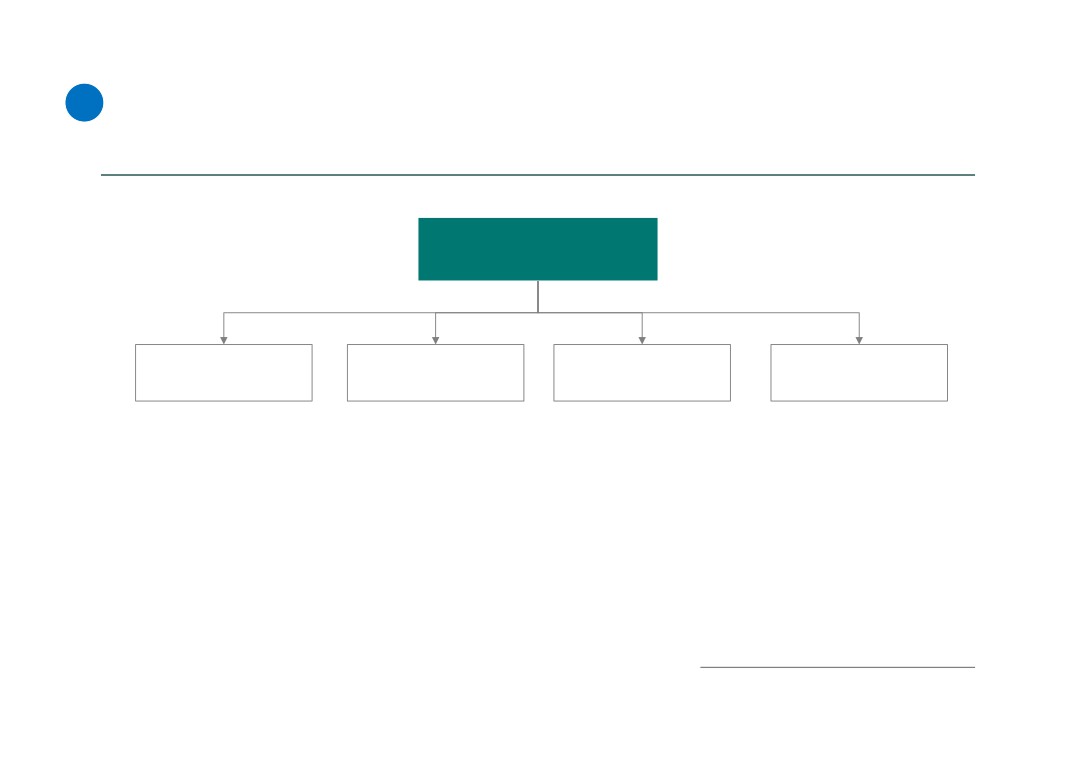

Uralchem controls 4 major production assets at the moment. Assets were

2

purchased by Mr. Mazepin mainly by using borrowed funds during the

period of 2004 - 2012

Structure of production assets of Uralchem as at 2018

Uralchem was

founded in 2007

URALCHEM

JSC Voskresensk

KCСP Branch

PMU Branch

Azot Branch

Mineral Fertilizers

How and for whose

PMU Branch, former

Azot Branch, former

In 2008, Uralchem

funds Mr. Mazepin

“Minudobreniya”, was

Berezniki “Azot”, was

received a loan from

acquired this asset?

purchased for USD 300 mln.

purchased in 2007. The

Sberbank in the amount

According to the press,

from SIBUR in 2012 (7)

value of the company is

of USD 700 mln., 382

KCСP Branch was

estimated by analysts

USD mln. of which were

purchased at auction for

approximately from USD

spent for the purchase

USD 108.35 mln. Where

264 mln. to 377 mln. (4)

of JSC VMF (5)

Mr. Mazepin could find

such significant personal

funds in 2004? Moreover,

during the tender Mr.

Mazepin managed to

overbid the offer of

Gazprom (3)

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

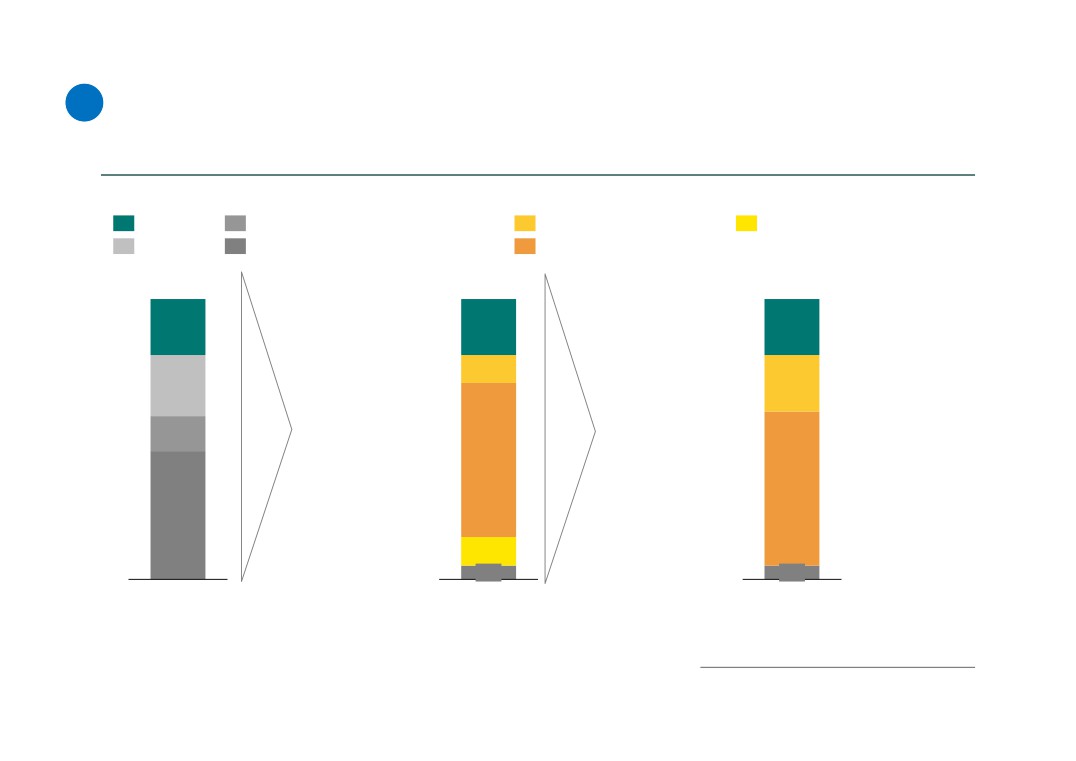

In the period from December 2013 to June 2019 Mr. Mazepin has achieved

3

effective ownership (control) over Uralkali of ~89%, squeezing out

ONEXIM of Mr. Prokhorov and minority shareholders

Dynamics of the change of equity structure of Uralkali from 2013 to 2019

Uralchem

Chengdong Investment Corp.

Rinsoco Trading (Mr. Lobyak)

Sberbank Investments

ONEXIM

Free-float

Uralkali-Technology

100%

100%

100%

RUB 126

bln. loan

from VTB

20%

20%

20%

Group

(8;9)

2014-2018

Rinsoco Trading.

Mr. Mazepin and Mr.

10%

Buy-out of ~55%

Mr. Lobyak

Lobyak formally

22%

20%

from minority

repurchased

control more than 40%,

shareholders for

back 10% from

but actually it is the full

more than RUB 247

Sberbank

control, as shares of

13%

bln. (12), including

Investments and

Uralkali-Technology are

credit funds from

became owner

quasi-treasury.

55%

the state banks of

with 20% of

Effective ownership

Russia (more than

shares (50)

(control) ~89% (14)

55%

USD 2 bln.) (11)

46%

10%

5%

5%

31 December

31 December

30 June

2013

2018

2019

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

From the end of 2012 to the end of 2018, the debt of Uralchem and Uralkali

4

for loans and borrowings was increased by more than 4.5 times or RUB 537

billion from RUB 154 billion to RUB 691 billion, of which RUB 590 billion were

raised for the purchase and buy-out of Uralkali shares

Dynamics of the balance of borrowed funds of Uralchem and Uralkali, RUB billion

Uralchem - borrowed funds (16)

Uralchem - loans for purchase of ~20% share in Uralkali

Uralkali - borrowed funds (16)

Uralkali - loans for buy-out of shares from minority shareholders

+536

Amount of loans spent by Mr.

(+347%)

Mazepin to seize the control over

Uralkali (with accumulated foreign

793

currency revaluation)

Acquisition of 20%

share in Uralkali by

689

691

Mr. Mazepin

314

615

590

554

257

282

238

237

268

(51)

305

479

142

431

409

154

377

317

322

30

(52)

163

124

2012

2013

2014

2015

2016

2017

2018

2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

In 2013, Uralchem received a loan from VTB for the purchase of ~20% share in

5

Uralkali. Due to the excessive debt burden and weak operating results, Uralchem was

forced to start refinancing in 2014 and 2018 to stabilize cash flows and cover debt

service costs

Dynamics of proceeds and repayments of loans and borrowings by Uralchem for the period

2013-2018, RUB billion

Proceeds from loans and borrowings (53)

Repayment of loans and borrowings (54)

181

147

The loan received form

VTB Group in the amount

of USD 4.5 bln. for the

purposes of purchase of

~20% share in Uralkali

Most of the debt repayment in

2014 and 2018 was carried out

98

by refinancing the debt with

new loans and borrowings

37

22

21

18

16

8

7

4

0

0

0

2013

2014

2015

2016

2017

2018

Accumulated for

the period of

2013-2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

6

Uralkali is not able to serve its debt and has to raise new loans to

finance existing debt on a systematic basis

Dynamics of proceeds and repayments of loans and borrowings by Uralkali for the period of

2013-2018, RUB billion

Proceeds from loans and borrowings (55)

Repayment of loans and borrowings (56)

831

The company is not able to continue its operations without refinancing

188

historical debt on loans and borrowings, by raising new borrowings in

each of the periods under review

705

158

155

151

142

143

121

122

111

108

86

51

2013

2014

2015

2016

2017

2018

Accumulated for

the period of

2013-2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

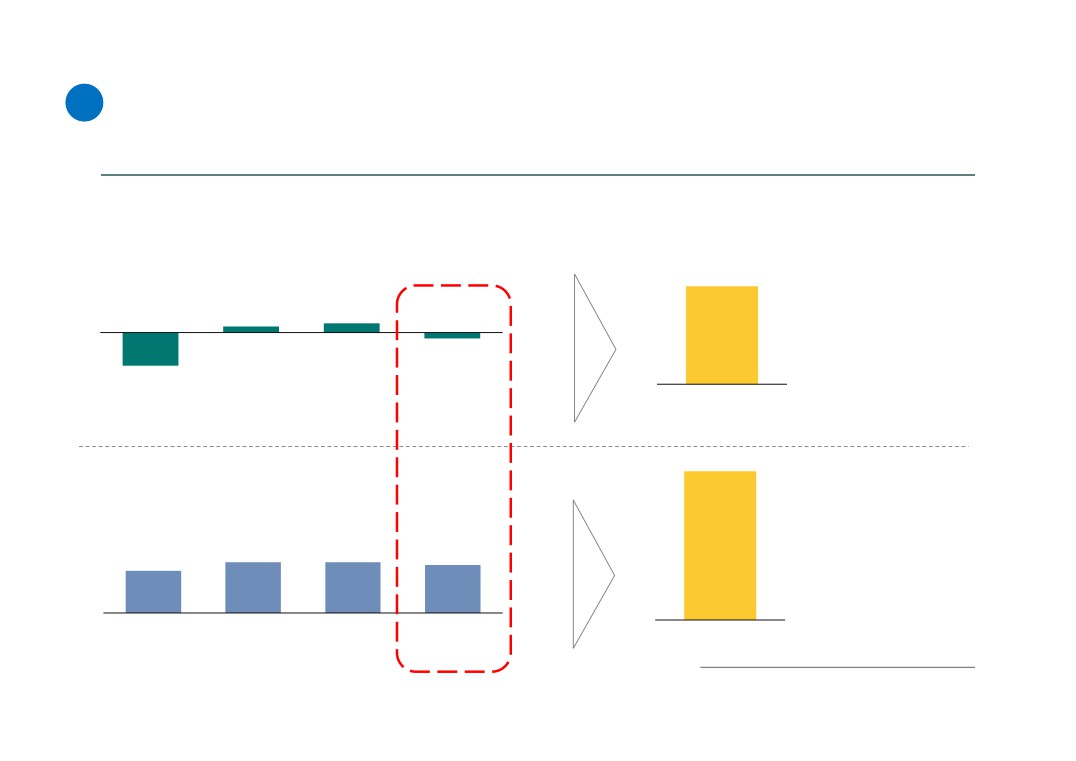

Since Mr. Mazepin’s arrival, Uralchem and Uralkali made capital expenditures

7

only for maintaining the companies in operating condition. No investments in

development and production expansion were made

-0.6

Capital expenditure (CAPEX), RUB bln. Uralchem (17), Uralkali (21)

(-5%)

Production volume, mln. tons Uralchem (57), Uralkali (23)

Uralkali

24.7

+2.1

► decrease of production volume from

(+21%)

18.2

2014 to 2018 was 5% or 0.6 mln. tons

► increase of production volume from 2013

12.8

12.9

12.1

12.0

to 2014 was 21% or 2.1 mln. tons, which

11.4

11.1

11.5

10.8

10.0

is explained by the capital expenditures

made earlier (before Mr. Mazepin’s

arrival) (58)

3.7

► increase of capital expenditure from 2014

is explained by expenses incurred for

liquidation of accidents in the mines,

2013

2014

2015

2016

2017

2018

including sinkhole

+0,4

Uralchem

(6%)

6,3

6,4

►

increase of production volume from

6,0

6,1

5,9

5,6

2013 to 2018 was only 6% or 0.4 mln.

5,1

tons

► capital expenditures in the total

3,2

3,2

amount of RUB 14.9 bln. since 2014

were directed only for maintaining the

2,3

business in operating condition and

1,1

1,1

not for development and production

expansion

2013

2014

2015

2016

2017

2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

The average annual cash flow from the operating activity of Uralkali for the

8

period of 2016-2018 after payment of interest and mandatory capital

expenditures to maintain business in operating condition was RUB 34 billion

Dynamics of operating cash flows of Uralkali for the period of 2013-2018, RUB billion

Net cash flow from operating activity before interest payments (plus) (59)

Interest payments (minus) (59)

Net cash flow = net cash flow from operating activity before

Х

interest payments - minus interest payments - minus CAPEX

CAPEX (capital expenditure) (minus) (59)

77

Annual average cash flow for the period

►

Increase of interest

2016-2018 is RUB 34 billion

payments in the period

of 2015-2016 is explained

by raising credit funds

30

36

for buy-out of shares

36

37

from minority

37

37

shareholders

107

►

Total amount of the

24

shares buy-out for the

76

75

66

period of 2014-2018 was

60

equal to RUB 247 bln.

37

(12)

-9

-10

-4

-17

-21

-19

-21

-13

-13

-11

-18

-25

2013

2014

2015

2016

2017

2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

The average annual cash flow from the operating activity of Uralchem for the

9 period of 2016-2018 after payment of interests and mandatory capital

expenditures to maintain business in operating condition was negative -

minus 1.7 billion rubles

Dynamics of operating cash flows of Uralchem for the period of 2013-2018, RUB billion

Net cash flow from operating activity before interest payments (plus) (60)

Interest payments (minus) (60)

Net cash flow = net cash flow from operating activity before

Х

interest payments - minus interest payments - minus CAPEX

CAPEX (capital expenditure) (minus) (60)

9

3

►

Increase of interest

2

payment is explained by

raising credit funds at the

end of 2013 in USD from

-10

VTB Group for the

0

purchase of ~20% share

24

23

21

in Uralkali, as well as

3

increase of ruble

13

10

equivalent more than 2

6

times due to ruble

-2

devaluation

-1

-9

►

In absolute values -

-13

-16

increase of balance of the

-1

-18

-17

loan received in USD

amounted to RUB 142 bln.

-2

(from RUB 126 bln. (8;9)

-3

to RUB 268 bln. (52))

-3

-5

2013

2014

2015

2016

2017

2018

Annual average cash flow for the period

of 2016-2018 is negative - RUB 1.7

billion

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

Mr. Mazepin will not be able to repay the loans to the banks.

Uralchem - repayment of borrowed funds in the amount of RUB 282 billion is impossible, as the

10

company had a negative annual cash flow for the period of 3 years in 2016-2018,

Uralkali - repayment of borrowed funds in the amount of RUB 409 billion is possible within 12

years, but it is unlikely due to competitor’s entry (EuroChem Group) to the market in 2019

Net cash flow from the operating activity after repayment of interests and

Borrowed funds

mandatory CAPEX required to maintain business in operating condition, RUB

as at 31 December 2018 (16)

billion (61)

Uralchem

282

Repayment of the debt is

2

3

impossible.

RUB 282 bln. of the debt

against negative RUB 1.7

-1.7

bln. average cash flow for

-10

the period of 2016-2018

2016

2017

2018

2016-2018

31 December 2018

(average figure)

409

Uralkali

Repayment is possible

36

36

34

during 409 / 34 = 12

30

years. However it is

unlikely due to entry to

the market of EuroChem

Group

2016

2017

2018

2016-2018

31 December 2018

(average annual

figure)

(Х) - Reference to the source of information. The full list of sources of

Mazepin Empire

information is presented at the end of the report

Since the end of 2013, capitalization of Uralkali has decreased by

more than 2.5 times from RUB 506 billion to RUB 246 billion. The

11

company's shares are pledged to the banks and are not sufficient

to cover its total debt

Dynamics of capitalization and total debt of Uralkali

for the period of 2013-2018, RUB billion

Capitalization (62), RUB bln. (29)

Total debt, RUB bln. (83)

+134%

(+388)

X

Share price, rubles (29)

-51%

(-260)

760

665

677

599

534

523

506

485

382

344

289

246

172

130

178

165

117

84

2013

2014

2015

2016

2017

2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

In accordance with p.4 of art.99 of the Civil Code of the Russian Federation, if

12 a joint-stock company has negative net assets during 2 and more years, it is

subject to liquidation. The net assets of Uralchem have been negative for 5

years since 2014

Dynamics of the net assets’ change of Uralchem

for the period of 2014-2018, RUB billion

Assets (63)

►

Net assets value of Uralchem

significantly depends on the

Liabilities (63)

317

market value of the 20%

Net assets

investment in Uralkali, as

285

well as the corresponding

(assets less liabilities)

263

share in the net profit of

239

242

Uralkali

234

222

►

Capitalization of Uralkali, as

well as a net profit share, will

169

172

continue to decline due to

161

162

156

the real competition in the

Russian potash market that

started in 2019

►

Thus, the historical trend of

the net assets changes will

continue to show the same

pattern toward decline

5

-41

-77

-73

-83

-113

2013

2014

2015

2016

2017

2018

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

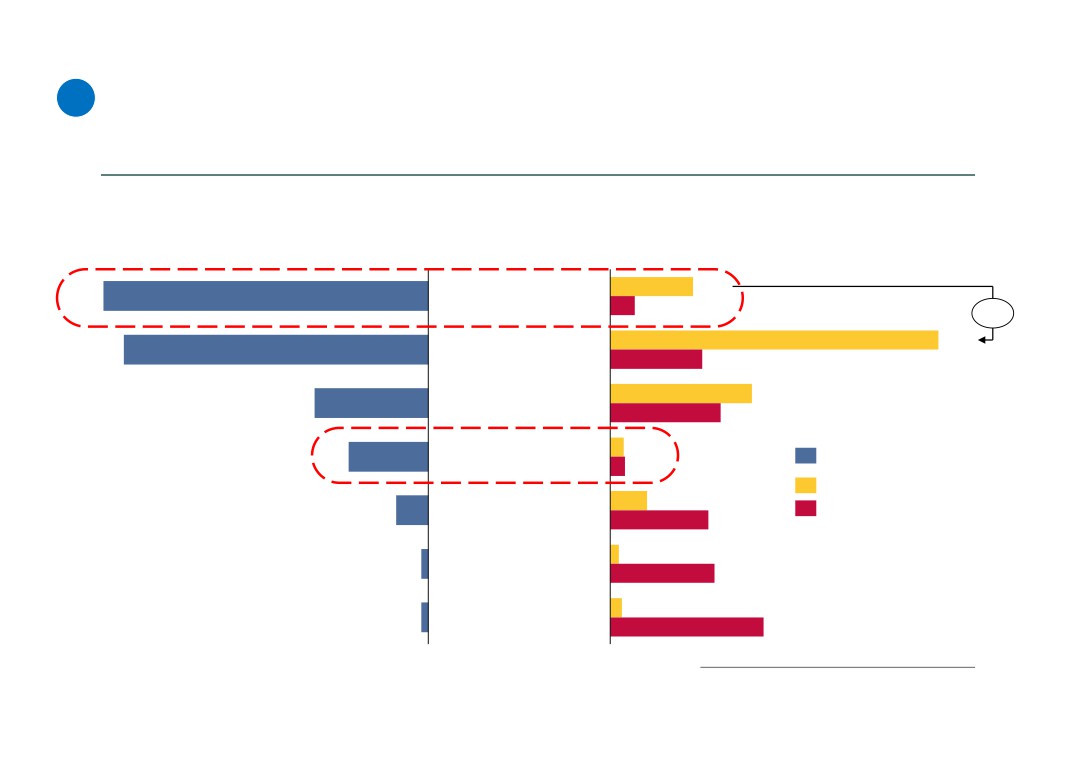

Uralkali, showing a positive trend of revenue and profit on sales, in fact has terminated

payment of dividends and significantly reduced income tax payments since 2014, i.e.

13

immediately after Mr. Mazepin’s arrival. For the period of 5 years in 2014-2018 only RUB

13.5 billion of income tax were paid. For comparison, before Mr. Mazepin’s arrival, for the

period of 3 years in 2011-2013 RUB 24.5 billion of income tax were paid

Dynamics of key performance indicators of Uralkali for the period of 2011-2018, RUB billion

Revenue (65)

Profit on sales (65;67)

Income tax (66)

Dividends paid (66)

Revenue and profit on sales

Income tax and dividend

157

2.5

2018

79

0.0

136

3.2

Result of work of

2017

63

0.0

Mr. Mazepin. After

his arrival at

131

2.6

Uralkali, the budget

2016

65

0.0

?

has received

nothing. Dividends

172

2.8

are not paid

2015

108

0.0

119

2.4

2014

59

10.7

96

5.5

2013

43

12.6

110

9.3

2012

63

25.4

100

9.7

2011

59

20.4

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

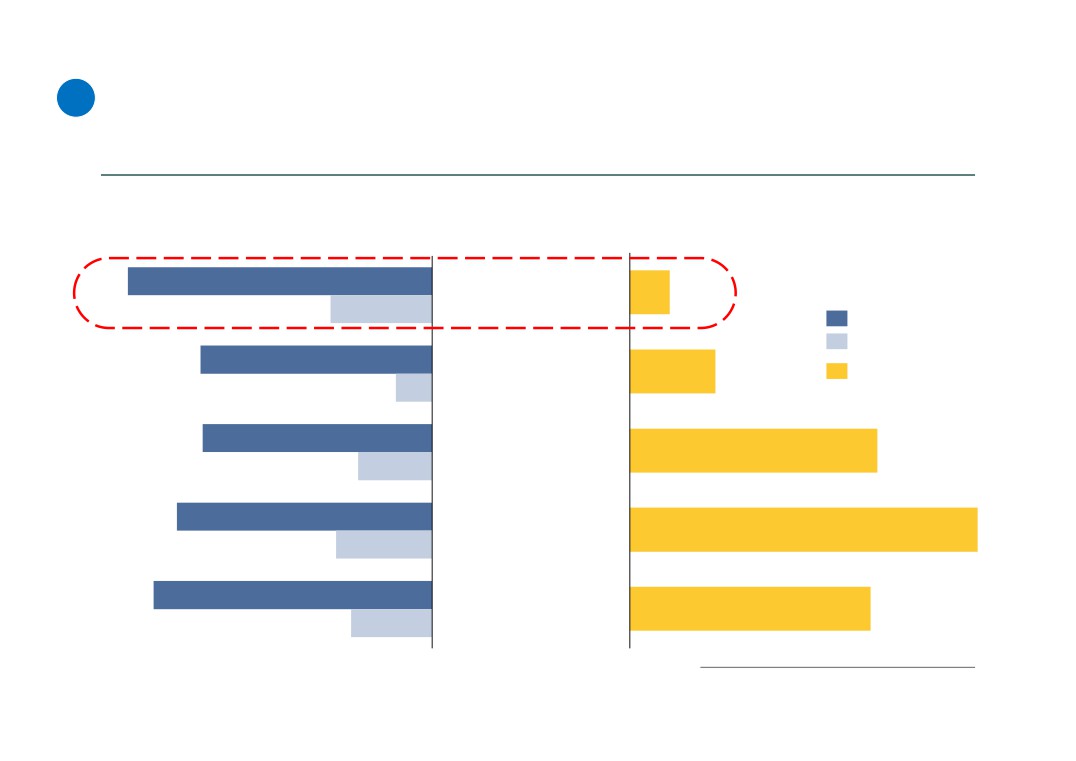

Uralkali, generating the largest profit on sales of Russian natural resources

in the Perm region (RUB 374 billion for the period of 5 years in 2014-2018),

14

paid only RUB 13.5 billion of income tax. For comparison, LUKOIL-Perm for

the same period paid 4 times more of income tax - by RUB 53.5 billion

The largest taxpayers of the Perm region

(accumulated in RUB billion for period of 5 years in 2014-2018)

Income tax paid (69) and

Profit on sales (67;68)

effective income tax rate (70)

13.5

374

Uralkali

4.0%

?

+40

53.5

351

LUKOIL - Perm

15.0%

LUKOIL -

23.1

131

Permneftegazsintez

18.0%

2.2

92

URALCHEM (64)

Profit on sales

2.4%

?

Income tax

6.0

37

Metafrax

16.0%

Effective income tax

(Income tax/Profit on sales)

1.4

8

Sveza Uralsky

17.0%

Gazprom

1.9

8

TransGaz

25.0%

Chaykovsky

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

Assumptions used in calculating the underpaid taxes of Uralkali to

15

the budget of the Russian Federation for the period of 2014-2018

►

The source of the amounts spent on the buy-out of shares from minority shareholders included in the calculation is data from the

annual IFRS financial statements of the Uralkali Group from 2014 to 2018 (Cash flow statement)

►

The amount of the buy-out of shares from minority shareholders is equal to the amount of the received loan proceeds for the

following reasons:

-net cash flow from operating activities over the period of 5 years in 2014-2018 with interest paid was equal to RUB 297 billion (71)

-the amount of capital expenditures over the period of 5 years in 2014-2018 was equal to RUB 80 billion (21)

-the total amount of the buy-out of shares from minority shareholders over the period of 5 years in 2014-2018 was equal to RUB

247 billion (12)

-the balance of borrowed funds was increased by RUB 246 billion from RUB 163 to RUB 409 billion from the end of 2013 to the end

of 2018 (16)

Thus:

1. the increase in the balance of borrowed funds (RUB 246 billion) since the end of 2013 completely matches the total amount of

the buy-out of shares (RUB 247 billion)

2. net cash flow from operating activities completely covered the capital expenditures for maintaining operating and production

volumes of the Company (see slide 7,8,9)

3. the remaining positive cash flows could have been used to repay earlier received loans, but this did not happen. Free cash

flows were used for the buy-out of shares, whereas loans were not repaid and were regularly refinanced and revalued due to the

devaluation of the ruble against the dollar

4. a significant amount of the shares buy-out was financed by raising additional loans and borrowings

►

Borrowed funds of Uralkali are denominated in USD. According to the IFRS Financial statements, at the end of 2018, RUB 97

billion (72) were borrowed funds in rubles, RUB 312 billion (72) - borrowed funds in USD. According to the IFRS Financial

statements, at the end of 2013, RUB 90 billion (73) - borrowed funds in rubles, RUB 73 billion (73) - borrowed funds in USD. Thus,

the increase in borrowed funds by RUB 246 billion only relates to borrowed funds in USD.

►

The estimated effective interest rate for the entire loan portfolio is not significantly different from the interest rate on loans

received for financing of the buy-out of shares from minority shareholders. This fact is not in dispute, since the amount of such

loans is more than 75% of the total loan portfolio (RUB 322 billion and RUB 409 billion (51;16) as at 31 December 2018,

respectively)

►

The income tax rate is 15.5%. The rate was changed during the reference period from 15.5% to 16.5%. For the purposes of

simplifying the calculations only one rate was used - 15.5%. The possible effect is only more than calculated

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

Assumptions used in calculating the underpaid taxes of Uralkali to

16 the budget of the Russian Federation for the period of 2014-2018

(continued)

►

If there was a tax loss that has been taken into account for the calculation of the annual taxable profit since 2014, the estimated

effect on income tax has been carried forward to the future tax periods. The overall effect of the underpaid income tax remains the

same

►

Dividend tax rate - 15% (for non-residents of the Russian Federation)

►

We understand that dividends should be paid from net profit and remain a decision that is to be taken by a general meeting of

shareholders

►

However, there is no doubt that the repayment of dividends have been actually terminated since 2014 due to Mr. Mazepin’s arrival at

Uralkali at the end of 2013 due to the following reasons:

► For the period of 4 years in 2011-2014, Uralkali paid RUB 69 billion of dividends, while for the period of 4 years in 2015-2018

only RUB 27 million

► Net profit for 4 years in 2011-2014 was equal to RUB 126 billion, while for the period of 4 years in 2015-2018, it was equal to

RUB 132 billion

► Thus, the net profit was increased by RUB 6 billion, whereas amount of dividends paid was only RUB 27 million instead of

RUB 69 billion. So, the dividend payments have been terminated

► The termination of dividend payments is explained by the lack of available cash, as all available funds were used for the

repayment and service of the debt (incl. fees, interest and foreign currency revaluation) for the loans obtained for the

purpose of the buy-out of shares from minority shareholders (the total amount of the buy-out was RUB 247 billion)

►

Therefore, two calculations were performed to calculate underpaid tax on dividends:

► The minimum amount of possible unpaid dividends is calculated based on historical data of dividend payments in

proportion to the profit on sales for the period of 3 years in 2011-2013 before the start of the buy-out of shares from minority

shareholders

► The maximum amount of possible unpaid dividends is calculated based on the statistics of dividend payments in proportion

to the profit on sales of LUKOIL-Perm, similar to Uralkali in terms of revenue and profit on sales for the same period of 5

years in 2014-2018. LUKOIL-Perm and Uralkali are two of the largest enterprises in the Perm region. The production activities

of both companies are based on the extraction of minerals in the Perm region of the Russian Federation

► The Line «Dividends paid» in the RAS Financial statements, Form №4, Cash flow statement of companies Uralchem,

LUKOIL-Perm also includes the tax paid on dividends

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

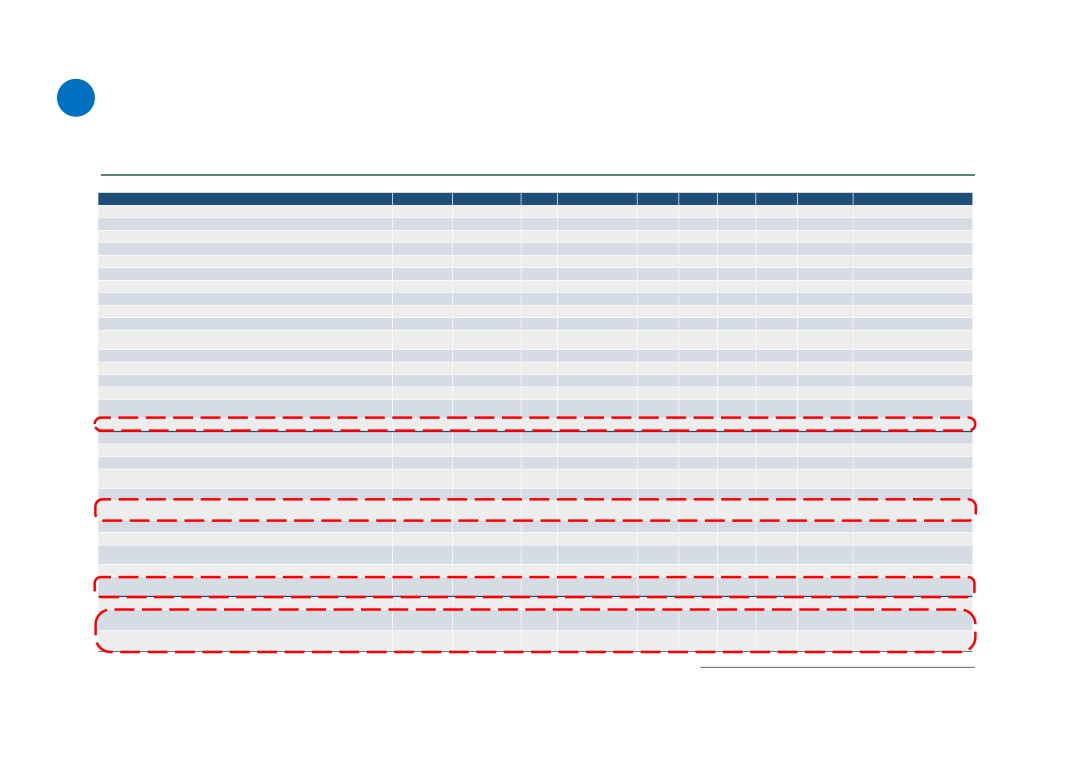

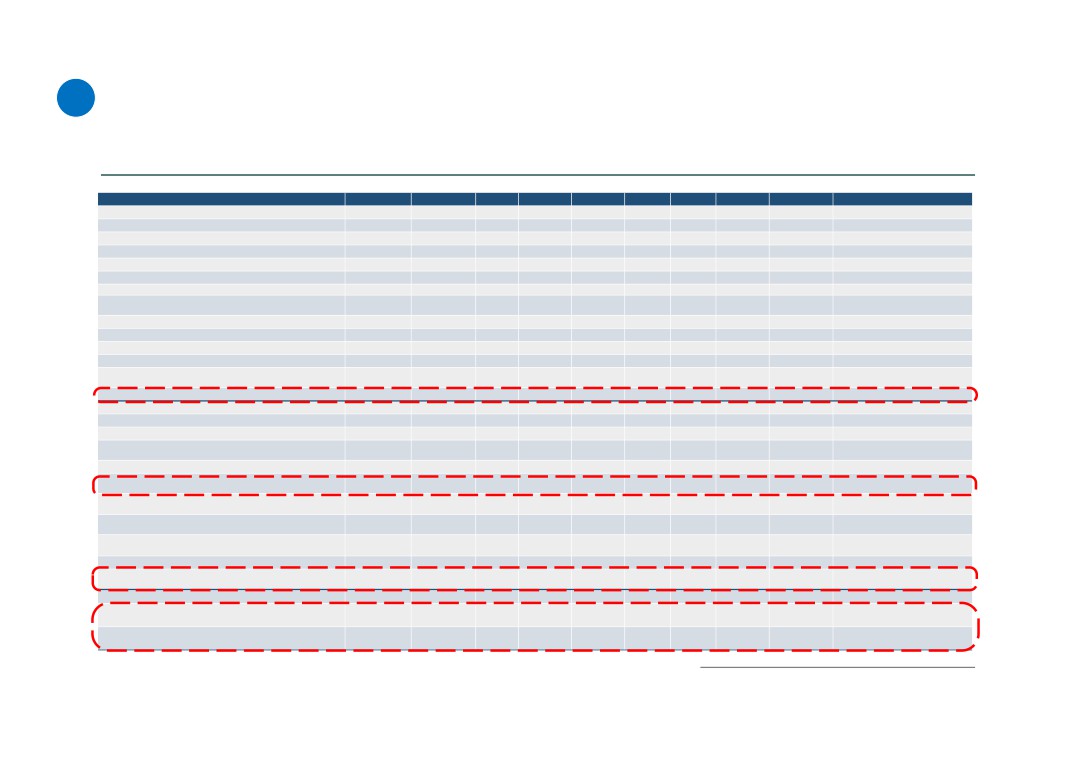

RUB 37.9 billion and RUB 54.1 billion - the minimum and maximum amounts

of the underpaid taxes of Uralkali to the budget of the Russian Federation for

17

the period of 2014-2018 due to raising credit financing for the buy-out of

shares from minority shareholders. It is 25% more than the budget of the city

of Perm for 2019 (RUB 28.4 billion)

i

0

1

2

3

4

5

6

7

Line

Unit of measure

2011-2013

2013

2014

2015

2016

2017

2018

2014-2018

Reference/Formula

INCOME TAX

Exchange rate (at the end of the period) (81)

RUB/USD

32,7

56,3

72,9

60,7

57,6

69,5

Xi

Exchange rate (at the end of the period), %

%

1,7

1,3

0,8

0,9

1,2

Qi=Xi/X(i-1)

Average exchange rate (84)

31,9

38,4

61,0

67,0

58,4

62,7

Ci

Loans and borrowings (16)

RUB bln.

163,1

316,6

478,8

431,1

377,0

408,9

Yi

Interest expense (76)

RUB bln.

9,0

10,1

16,9

21,3

18,8

20,3

Zi

Interest expense, effective rate

%

4,2%

4,3%

4,7%

4,7%

5,2%

Vi=Zi/(Yi-Y(i-1)/2)

Loans for buy-out of shares (12)

RUB bln.

64,6

140,3

33,6

1,5

7,1

Fi

Loans for buy-out of shares, accumulated

RUB bln.

64,6

204,9

238,5

240,0

247,1

Wi=Wi-1+Fi

Loans for buy-out of shares (currency equivalent)

USD bln.

1,68

2,30

0,50

0,03

0,11

Hi=Fi/Ci

Loans for buy-out of shares (currency equivalent), accumulated

USD bln.

1,7

4,0

4,5

4,5

4,6

Ji=J(i-1)+Hi

Foreign currency revaluation for loans

RUB bln.

39,6

47,1

-

51,8

-

13,7

54,2

75,3

Si=(Wi-W(i-1)/2)*Qi

Foreign currency revaluation for loans, accumulated

RUB bln.

39,6

86,6

34,9

21,1

75,3

Ri=R(i-1)+Si

Loans with accumulated foreign currency revaluation

RUB bln.

104,2

291,5

273,4

261,2

322,4

Li=Wi+Ri

Interest expense for the loans

RUB bln.

2,2

8,4

13,2

12,4

15,1

51,4

XXi=(Li-L(i-1)/2)*Vi

Additional expenses recognized for the decrease of the taxable profit

RUB bln.

41,8

55,5

-

38,5

-

1,3

69,3

126,7

Ui=XXi+Si

Underpaid income tax

RUB bln.

6,5

8,6

-

6,0

-

0,2

10,7

19,6

TAX1i=Ui*15,5%

DIVIDEND TAX

Profit on sales (68)

RUB bln.

165,1

58,9

108,4

65,2

62,7

78,9

374,2

Ti

Actually dividends paid (82)

RUB bln.

58,4

10,7

0,02

0,01

-

-

10,7

Mi

(Dividends/Profit on sales) for 2011-2013 * 100%

%

35,4%

N0=M0/T0

Possible unpaid dividends - MIN

RUB bln.

10,2

38,3

23,1

22,2

27,9

121,7

Bi=Ti*N0-Mi

Underpaid tax for possible unpaid dividends - MIN

RUB bln.

1,5

5,7

3,5

3,3

4,2

TAX2i=Bi*15%

18,3

Profit on sales - LUKOIL-Perm (68)

RUB bln.

45,4

66,5

69,8

69,8

99,1

350,6

Oi

Dividends - LUKOIL-Perm (82)

RUB bln.

28,3

24,0

77,3

36,7

49,0

215,3

Ai

(Dividends/Profit on sales) for 2014-2018 - LUKOIL-Perm

%

62,2%

36,1%

110,8%

52,6%

49,5%

61,4%

Ei=Ai/Oi

Possible unpaid dividends - MAX

RUB bln.

36,2

66,6

40,1

38,5

48,5

229,8

Gi=Ti*E7

Underpaid tax for possible unpaid dividends - MAX

RUB bln.

5,4

10,0

6,0

5,8

7,3

TAX3i=Gi*15%

34,5

TOTAL:

Underpaid tax to the budget of Russian Federation - MIN

RUB bln.

8,0

14,4

-

2,5

3,1

14,9

TAX1i+TAX2i

37,9

Underpaid tax to the budget of Russian Federation - MAX

RUB bln.

11,9

18,6

0,0

5,6

18,0

TAX1i+TAX3i

54,1

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

Uralchem has the highest revenue and profit on sales compared to its competitors, but does not

18

pay taxes on profit and dividends to the budget- only RUB 2.7 billion have been paid since the

end of 2013. For example, two comparable companies belonging to the Swiss Group EuroChem,

Nevinnomyssk Azot and NAK Azot, having a lower profit margin on sales, has paid RUB 39.9

billion since the end of 2013 - 15 times more than Uralchem

Key performance indicators of analogues companies in comparison with Uralchem

(accumulated in RUB billion for period of 5 years in 2014-2018)

Financial Indicators (74)

Tax payments to the budget of RF (75)

275

URALCHEM

2.7

92

?

Revenue

Profit on sales

210

Tax on profit and

KuibyshevAzot

5.7

33

dividends (in total)

207

EhroChem -

16.6

Nevinnomyssk Azot

67

231

EuroChem -

23.3

NAK Azot

87

252

Togliattiazot

16.1

73

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

Assumptions used in calculating the underpaid taxes of Uralchem

19 to the budget of the Russian Federation for the period of 2014-

2018

►

The loan amount in USD received from VTB Group in December 2013 for the purposes of financing the acquisition of 20% shares

in Uralkali was equal to RUB 126.3 billion in the ruble equivalent (8)

►

The estimated effective interest rate for the entire loan portfolio is not significantly different from the interest rate on loans

received for financing of the acquisition of the shares. This fact is not in dispute, since the amount of such loans is more than

90% of the total loan portfolio of the company (RUB 268 billion and RUB 282 billion (52;16) as at 31 December 2018, respectively)

►

Income tax rate - 20%

►

If there was a tax loss that has been taken into account for the calculation of the annual taxable profit since 2014, the estimated

effect on income tax has been carried forward to the future tax periods. The overall effect of the underpaid income tax remains the

same

►

Dividend tax rate - 15% (for non-residents of the Russian Federation)

►

We understand that dividends should be paid from net profit and remain a decision that is to be taken by a general meeting of

shareholders

►

Nevertheless, there is no doubt that the dividend payments have been actually terminated since 2015 in connection with the

purchase of the 20% share in Uralkali by using the loan proceeds received from VTB Group:

► Profit on sales for the period of 2015-2018 amounted to RUB 82 billion, for the period of 2011-2013 - RUB 32 billion

► The amount of dividends paid for the period of 2011-2014 was RUB 11.2 billion. For the period of 2015-2018, no dividends

were paid

► Thus, the profit on sales increased 2.5 times from RUB 32 billion to RUB 82 billion, but dividend payments were terminated

► Net profit was reduced due to interest, exchange rate revaluation, as well as accrual of reserves for the investment in

Uralkali (as the share price decreased more than 2 times since the acquisition). For the period of 2014-2018, Uralchem

showed a net loss of RUB 96 billion, while profit on sales was positive RUB 92 billion

► The termination of dividend payments is explained by the lack of available cash, as all available funds were used for the

repayment and service of the debt (incl. fees, interest and foreign currency revaluation) for the loans obtained for the

purpose of the buy-out of shares from minority shareholders (RUB 126 billion in ruble equivalent)

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

Assumptions used in calculating the underpaid taxes of Uralchem

20 to the budget of the Russian Federation for the period of 2014-

2018 (continued)

► Therefore, two calculations were performed to calculate underpaid tax on dividends:

► The minimum amount of possible unpaid dividends is calculated based on historical data of dividend payments in

proportion to sales over a period of 3 years in 2011-2013 prior to raising the loan proceeds for financing of the acquisition

of the 20% shares in Uralkali

► The maximum amount of possible unpaid dividends is calculated based on the statistics of dividend payments in

proportion to the profit on sales of comparable to Uralchem companies in terms of revenue and profit on sales for the

same period of 5 years in 2014-2018. These are companies of EuroChem Group - Nevinnomyssk Azot and NAK Azot

► The Line «Dividends paid» in the RAS Financial statements, Form #4, Cash flow statements of companies Uralchem, EuroChem -

Nevinnomyssk Azot and NAK Azot also includes the tax paid on dividends

(Х) - Reference to the source of information. The full list of sources of

information is presented at the end of the report

Mazepin Empire

RUB 45.8 billion and RUB 51.8 billion - the minimum and maximum amounts

of the underpaid taxes of Uralchem to the budget of the Russian Federation

21

for the period of 2014-2018 due to raising credit financing for the purchase of

~20% shares in Uralkali. It is 1.5 times more than the budget of the city of

Perm for 2019 (RUB 28.4 billion)

i

0

1

2

3

4

5

6

7

Line

Unit of measure

2011-2013

2013

2014

2015

2016

2017

2018

2014-2018

Reference/Formula

INCOME TAX

Exchange rate (at the end of the period) (81)

RUB/USD

32,7

56,3

72,9

60,7

57,6

69,5

Xi

Exchange rate (at the end of the period) ), %

%

171,9%

222,7%

185,3%

176,0%

212,3%

Qi=Xi/X(i-1)

Loans and borrowings (16)

RUB bln.

141,6

237,0

314,1

257,4

237,9

281,6

Yi

Interest expense (76)

RUB bln.

1,5

7,9

12,7

18,4

15,8

17,0

Zi

Interest expense, effective rate

%

4,1%

4,6%

6,4%

6,4%

6,5%

V=Zi/(Yi-Y(i-1)/2)

Amount of the loan for acquisition of 19,99% (8,10)

RUB bln.

126,3

126,3

126,3

126,3

126,3

126,3

Wi

Amount of the loan for acquisition of 19,99% (currency equivalent)

USD bln.

3,9

3,9

3,9

3,9

3,9

3,9

Ji=Wi/X1

Foreign currency revaluation for the loan

RUB bln.

-

90,8

64,1

-

47,2

-

11,8

45,8

141,7

Si=(Wi-W(i-1)/2)*Qi

Foreign currency revaluation, accumulated

RUB bln.

90,8

154,9

107,7

95,9

141,7

Ri=R(i-1)+Si

Loan with accumulated foreign currency revaluation

RUB bln.

126,3

217,0

281,2

234,0

222,2

268,0

Li=Wi+Ri

Interest expense for the loan

RUB bln.

7,1

11,5

16,6

14,6

16,0

65,8

XXi=(Li-L(i-1)/2)*Vi

Additional expenses recognized for the decrease of the taxable profit

RUB bln.

97,9

75,6

-

30,6

2,8

61,8

207,5

Ui=XXi+Si

Underpaid income tax

RUB bln.

19,6

15,1

-

6,1

0,6

12,4

TAX1i=Ui*20%

41,5

DIVIDEND TAX

Profit on sales (74)

RUB bln.

22,6

9,4

20,6

16,9

16,7

28,2

91,8

Ti

Actually dividends paid (75)

RUB bln.

7,9

3,3

-

-

-

-

3,3

Mi

(Dividends paid/Profit on sale) for 2011-2013 * 100%

%

34,9%

N0=M0/T0

Possible unpaid dividends - MIN

RUB bln.

-

0,0

7,2

5,9

5,8

9,9

28,7

Bi=Ti*N0-Mi

Underpaid tax for possible unpaid dividends - MIN

RUB bln.

-

0,0

1,1

0,9

0,9

1,5

TAX2i=Bi*15%

4,3

Profit on sales - EuroChem - Nevinnomyssk Azot and NAK Azot

RUB bln.

24,1

44,4

27,7

23,8

33,9

153,9

Oi

(total) (74)

Dividends - Nevinnomyssk Azot and NAK Azot (total) (75)

RUB bln.

34,2

30,6

19,3

17,8

13,0

114,9

Ai

(Dividends/Profit on sales) for 2014-2018 - Nevinnomyssk Azot and

%

141,9%

68,9%

69,9%

74,7%

38,3%

74,7%

Ei=Ai/Oi

NAK Azot (total)